The Agreement Delaware form is a legally binding document specifically designed for the sale and purchase of residential real estate in Delaware. This form outlines essential details such as the parties involved, property description, payment terms, and contingencies, ensuring clarity...

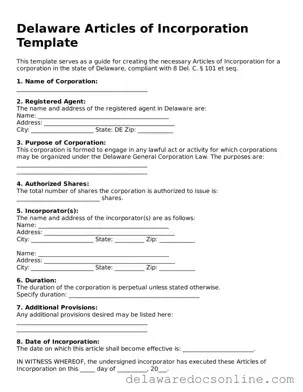

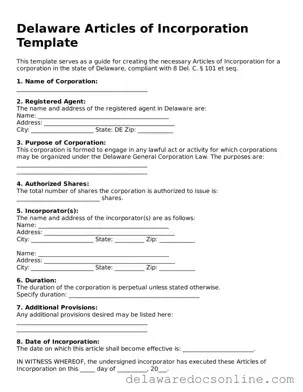

The Delaware Articles of Incorporation form is a legal document used to establish a corporation in the state of Delaware. This form outlines essential details about the corporation, including its name, purpose, and structure. Filing this document is a crucial...

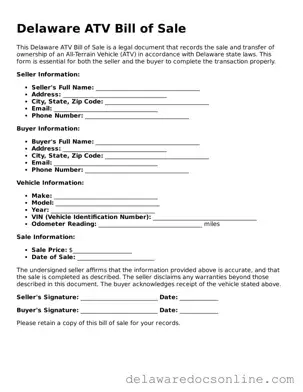

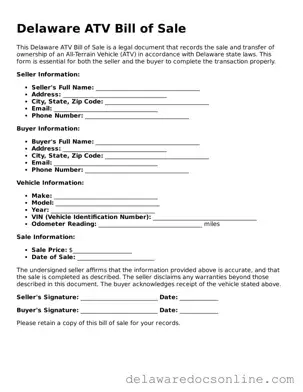

The Delaware ATV Bill of Sale form is a legal document used to record the transfer of ownership of an all-terrain vehicle (ATV) in the state of Delaware. This form serves as proof of sale and outlines essential details such...

A Delaware Bill of Sale form is a legal document that serves as proof of the transfer of ownership of personal property from one individual to another. This form outlines essential details such as the description of the item, the...

The Delaware Boat Bill of Sale form is a legal document used to record the transfer of ownership of a boat from one party to another. This form serves as proof of the sale and includes essential details about the...

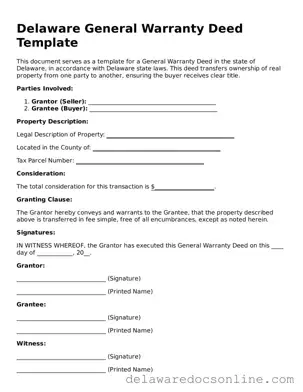

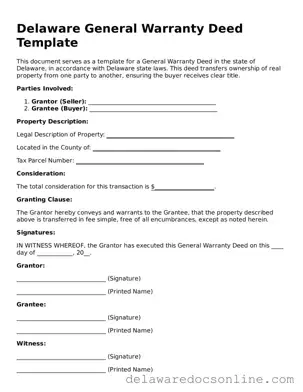

The Delaware Deed form is a legal document used to transfer property ownership in the state of Delaware. This form outlines the specifics of the transaction, including details about the buyer, seller, and the property itself. Understanding its components is...

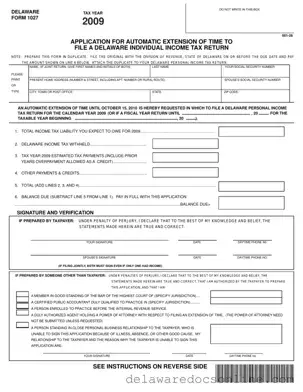

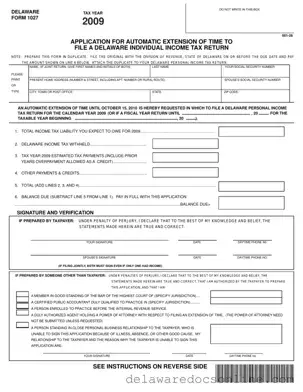

The Delaware 1027 form serves as an application for an automatic extension of time to file an individual income tax return in Delaware. This form allows taxpayers to request an extension until October 15 of the tax year, providing them...

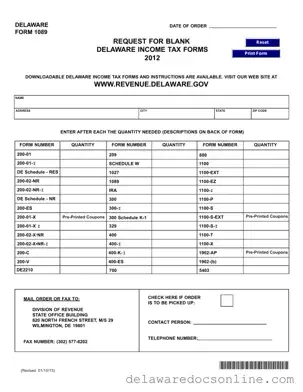

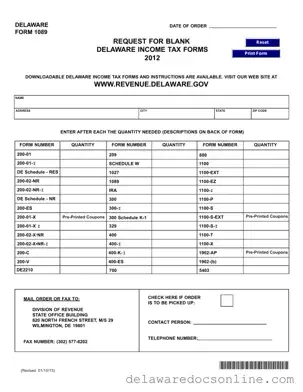

The Delaware 1089 form is a request for blank Delaware income tax returns. This form is essential for individuals or entities needing to obtain the necessary tax forms for filing. Understanding how to properly use this form can streamline your...

The Delaware 1100EZ form is a simplified corporate income tax return designed for businesses operating in Delaware with a Federal Taxable Income of less than $10 million. This form allows corporations to report their income and calculate their tax liability...

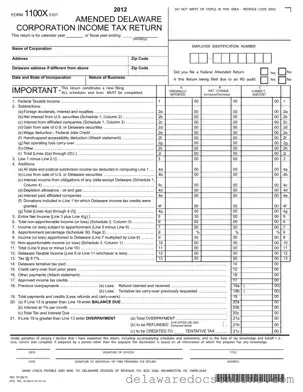

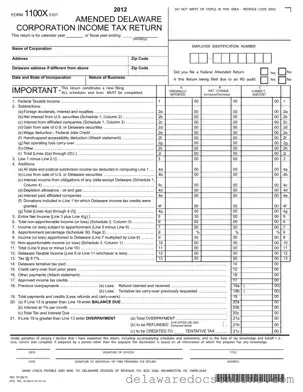

The Delaware 1100X form is an amended corporate income tax return used by businesses operating in Delaware. This form allows corporations to correct previously filed tax returns for the calendar or fiscal year. Completing the 1100X ensures accurate reporting of...

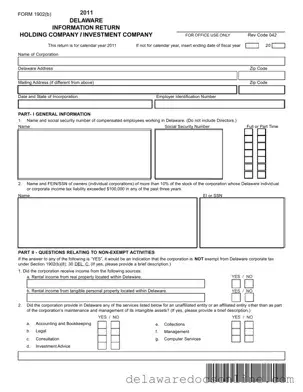

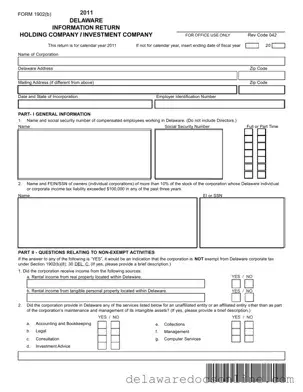

The Delaware 1902 B form is an annual information return specifically designed for holding companies and investment companies claiming exemption from Delaware corporate income tax. This form must be filed by corporations that limit their activities to managing intangible investments...

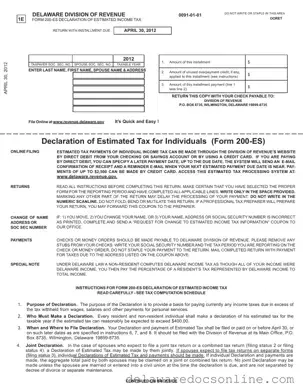

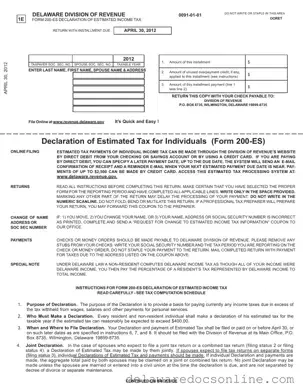

The Delaware 200 Es form is a declaration of estimated income tax return for individuals, designed to help taxpayers manage their tax obligations effectively. This form is essential for both residents and non-residents who expect their tax liability to exceed...