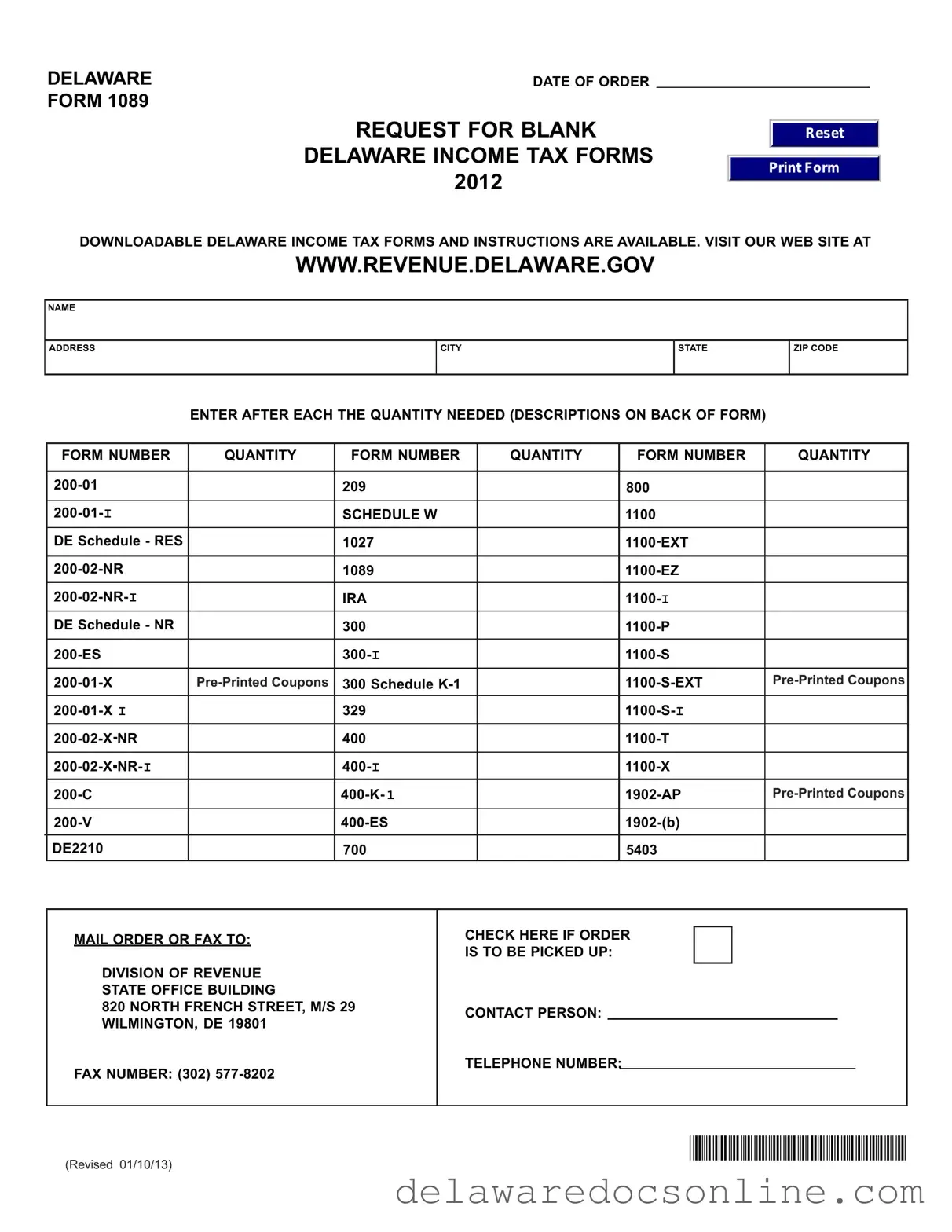

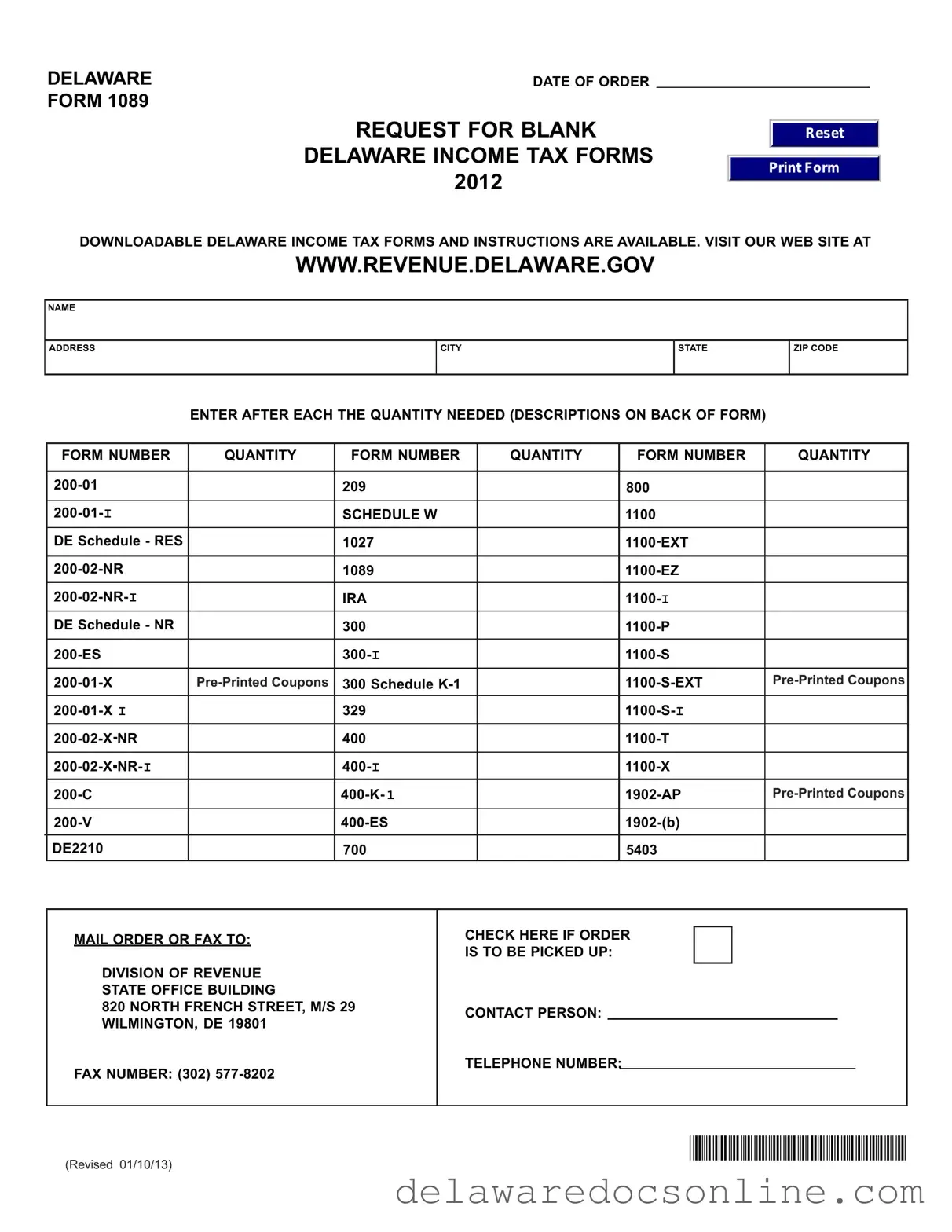

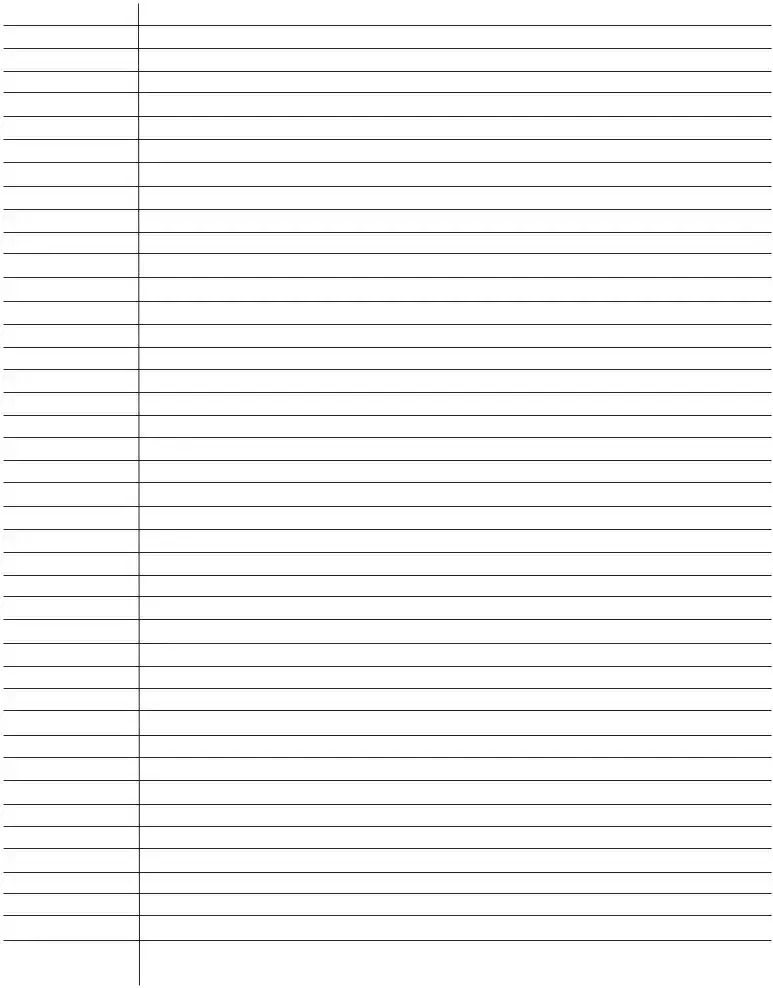

FORM NUMBER |

DESCRIPTION |

200-01 |

INDIVIDUAL RESIDENT INCOME TAX RETURN |

200-01-I |

INSTRUCTIONS FOR INDIVIDUAL RESIDENT INCOME TAX RETURN |

DE Schedule - RES |

DELAWARE RESIDENT SCHEDULES I, II, III |

200-02-NR |

INDIVIDUAL NON-RESIDENT INCOME TAX RETURN |

200-02-NR-I |

INSTRUCTIONS FOR INDIVIDUAL NON-RESIDENT INCOME TAX RETURN |

DE Schedule - NR |

DELAWARE NON-RESIDENT SCHEDULE I AND III |

200-ES |

ESTIMATED INCOME TAX RETURN BOOKLET (OCR BOOKLET, NOT DISTRIBUTED BLANK) |

200-01-X |

AMENDED DELAWARE RESIDENT PERSONAL INCOME TAX RETURN |

200-01-X-I |

INSTRUCTIONS FOR AMENDED DELAWARE RESIDENT PERSONAL INCOME TAX RETURN |

200-02-X-NR |

AMENDED DELAWARE NON-RESIDENT PERSONAL INCOME TAX RETURN |

200-02 X-NR-I |

INSTRUCTIONS FOR AMENDED DELAWARE NON-RESIDENT PERSONAL INCOME TAX RETURN |

200-C |

COMPOSITE PERSONAL INCOME TAX RETURN WITH INSTRUCTIONS |

200-V |

ELECTRONIC FILER PAYMENT VOUCHER FORM |

2210 |

UNDERPAYMENT OF ESTIMATED TAXES |

209 |

CLAIM FOR REFUND DUE ON BEHALF OF DECEASED TAXPAYER |

SCHEDULE W |

SCHEDULE OF DAYS WORKED OUTSIDE OF STATE |

1027 |

APPLICATION FOR AUTOMATIC EXTENSION OF TIME TO FILE DELAWARE INDIVIDUAL INCOME TAX |

1089 |

REQUEST FOR BLANK DELAWARE INCOME TAX RETURNS |

IRA |

DELAWARE SPECIAL TAX COMPUTATION FOR INDIVIDUAL RETIREMENT ACCOUNT DISTRIBUTION |

300 |

PARTNERSHIP RETURN |

300-I |

INSTRUCTIONS FOR PARTNERSHIP RETURN |

300 Schedule K-1 |

PARTNERS SHARE OF INCOME |

329 |

LUMP SUM DISTRIBUTION FROM QUALIFIED RETIREMENT PLAN |

400 |

FIDUCIARY RETURN |

400-I |

INSTRUCTIONS FOR FIDUCIARY RETURN |

400 Schedule K-1 |

BENEFICIARY’S INFORMATION |

400-ES |

FIDUCIARY ESTIMATE TAX RETURN BOOKLET |

700 |

BUSINESS TAX CREDITS FORM WITH INSTRUCTIONS |

800 |

BUSINESS INCOME OF NON-RESIDENT FORM WITH INSTRUCTIONS |

1100 |

CORPORATION INCOME TAX RETURN |

1100-EXT |

CORPORATE INCOME TAX REQUEST FOR EXTENSION |

1100-S-EXT |

S CORPORATION INCOME TAX REQUEST FOR EXTENSION |

1100-EZ |

CORPORATION INCOME TAX RETURN (SHORT FORM) |

1100-I |

INSTRUCTIONS FOR CORPORATION INCOME TAX RETURN |

1100-P |

S CORPORATION ESTIMATED TAX RETURN BOOKLET (OCR BOOKLET, NOT DISTRIBUTED BLANK) |

1100-S |

SMALL BUSINESS CORPORATION INCOME TAX RETURN |

1100 S-I |

INSTRUCTIONS FOR SMALL BUSINESS CORPORATION INCOME TAX RETURN |

1100-T |

CORPORATE TENTATIVE TAX RETURN BOOKLET (OCR BOOKLET, NOT DISTRIBUTED BLANK) |

1100-X |

AMENDED CORPORATION INCOME TAX RETURN |

1902-AP |

APPLICATION FOR EXEMPTION FROM CORPORATION INCOME TAX |

1902-(b) |

DELAWARE INFORMATION RETURN HOLDING COMPANY/INVESTMENT COMPANY |

5403 |

DELAWARE REAL ESTATE TAX RETURN DECLARATION OF ESTIMATED TAXES |