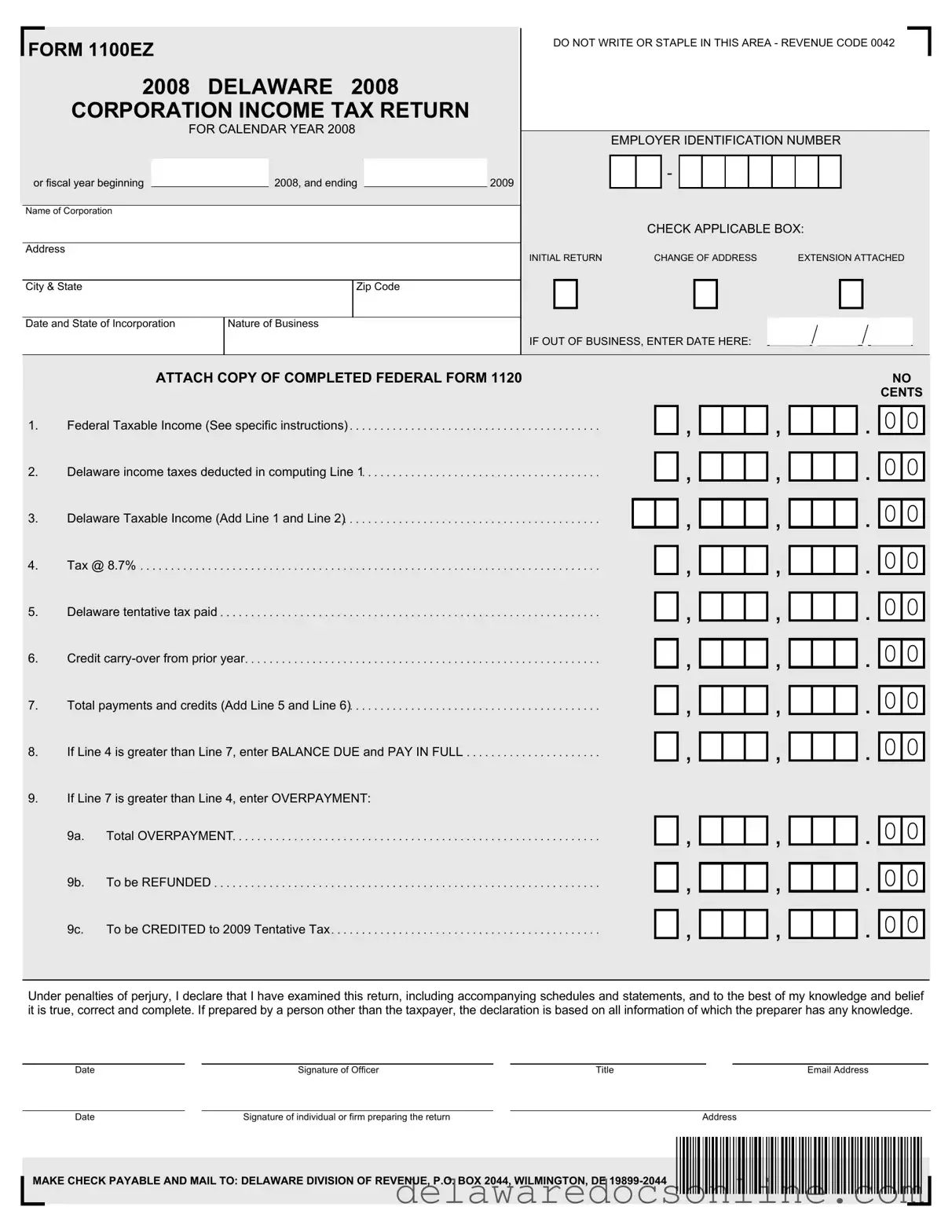

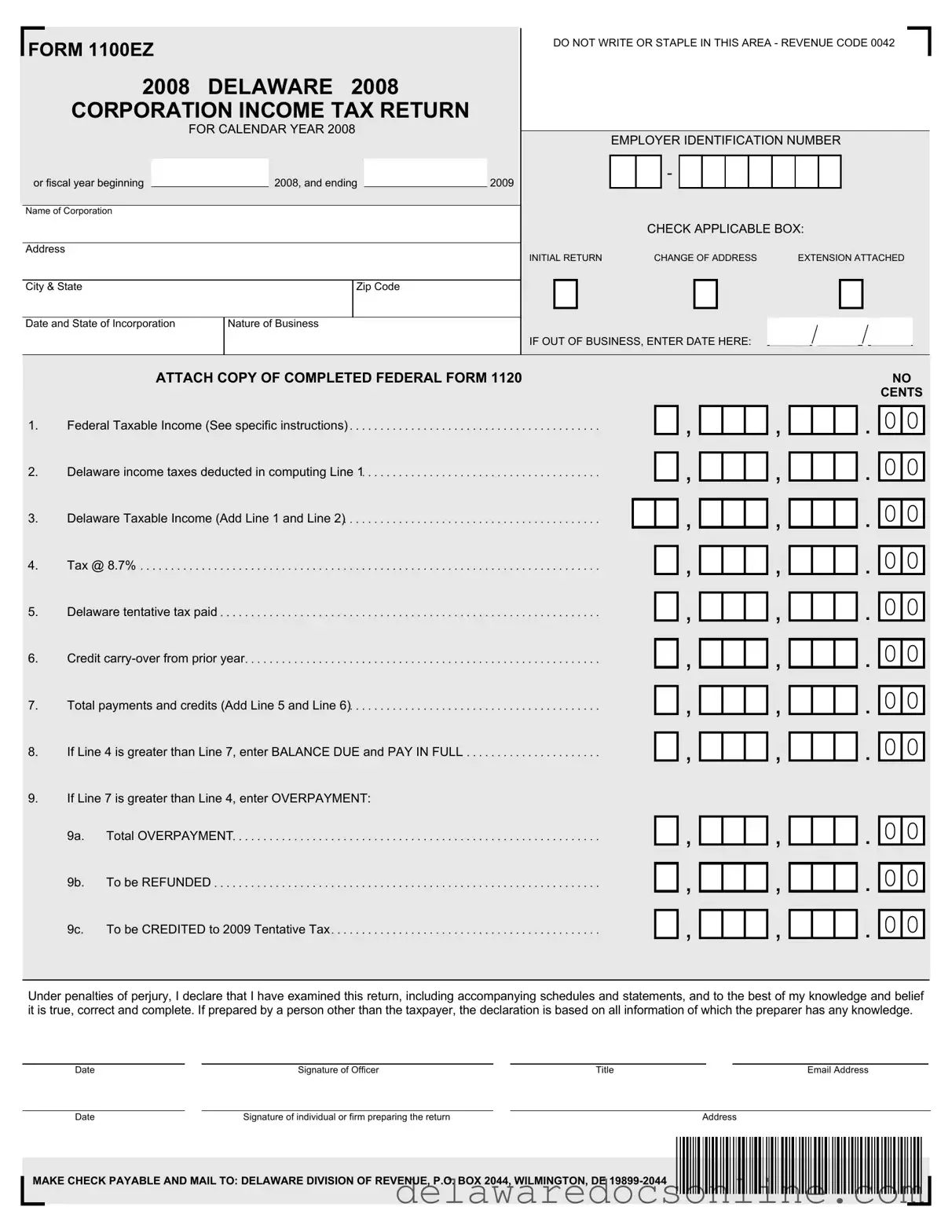

FORM 1100EZ |

|

DO NOT WRITE OR STAPLE IN THIS AREA - REVENUE CODE 0042 |

|

|

|

|

2008 |

DELAWARE 2008 |

|

|

|

CORPORATION INCOME TAX RETURN |

|

|

|

FOR CALENDAR YEAR 2008 |

|

EMPLOYER IDENTIFICATION NUMBER |

|

|

|

or fiscal year beginning |

2008, and ending |

2009 |

- |

|

|

|

Name of Corporation |

|

|

|

|

|

|

|

CHECK APPLICABLE BOX: |

Address |

|

INITIAL RETURN |

CHANGE OF ADDRESS |

EXTENSION ATTACHED |

|

|

City & State |

Zip Code |

|

|

|

Date and State of Incorporation |

Nature of Business |

|

|

|

|

|

IF OUT OF BUSINESS, ENTER DATE HERE: |

|

|

|

NO |

|

|

CENTS |

, |

, |

. 0 0 |

, |

, |

. 0 0 |

, |

, |

. 0 0 |

, |

, |

. 0 0 |

, |

, |

. 0 0 |

, |

, |

. 0 0 |

, |

, |

. 0 0 |

, |

, |

. 0 0 |

9.If Line 7 is greater than Line 4, enter OVERPAYMENT:

, |

, |

. 0 0 |

, |

, |

. 0 0 |

, |

, |

. 0 0 |

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief it is true, correct and complete. If prepared by a person other than the taxpayer, the declaration is based on all information of which the preparer has any knowledge.

Date |

Signature of Officer |

Title |

Email Address |

|

|

|

|

|

|

Date |

Signature of individual or firm preparing the return |

|

Address |

MAKE CHECK PAYABLE AND MAIL TO: DELAWARE DIVISION OF REVENUE, P.O. BOX 2044, WILMINGTON, DE 19899-2044

Enter on Line 1 the amount of your Federal Taxable Income (Line 30, Federal Form 1120).

Enter on Line 2 the amount of all Delaware net income taxes computed on the basis of, or in lieu of, net income or net profit that are imposed by the State of Delaware or political subdivision of the State of Delaware and were deducted in computing Federal Taxable Income.

Add Line 1 and Line 2 and enter on Line 3. Multiply Line 3, Delaware Taxable Income, by 8.7%.

Enter on Line 5 the amount of Delaware Tentative Tax paid.

Enter on Line 6 the amount of credit carryover from the immediately preceding taxable year.

Enter on Line 7 the sum of the payments from Line 5 and Line 6. This amount represents the total credits available to be applied against the tax liability on Line 4.

Subtract Line 7 from Line 4. If Line 4 is greater than Line 7, enter on Line 8 the BALANCE DUE to be paid in full.

INSTRUCTIONS FOR FORM 1100EZ

Use FORM 1100EZ Only If:

1.Your Federal Taxable Income (Line 30, Federal Form 1120) is less than $10,000,000,

2.The addback of Delaware corporate income taxes deducted in computing Federal Taxable Income is the only modification to Federal Taxable Income and

3.All property owned and rented is located in Delaware, all wages and salaries are paid to employees working in Delaware and goods sold or services rendered are delivered or performed in Delaware.

SPECIFIC INSTRUCTIONS

Calendar Or Fiscal Year Operation

This 2008 Form 1100EZ is used to report your Delaware corporate income tax for calendar year 2008 or fiscal year beginning in 2008 and ending in 2009. If the corporation conducts business on a fiscal year basis, enter the beginning and ending dates of the fiscal year in a MM/DD/YYYY format.

Name, Address And Employer Identification Number

Enter the complete name, address and employer identification number of the corporation. Employer identification numbers are issued by the Internal Revenue Service by filing Federal Form SS4.

Date And State Of Incorporation And Nature Of Business

Enter the date in MM/YYYY format and the state in which the corporation is incorporated. Enter a short phrase to describe the nature of business conducted by the corporation.

Check The Applicable Box

Check the Initial Return box if this is the first time the corporation is filing a Delaware corporate income tax return. Check the Change Of Address box if the address of the corporation has changed from the previous year's filing. Check the Extension Attached box if the corporation has obtained an approved federal or Delaware extension of time to file the corporate income tax return.

Out Of Business

Enter the exact date in MM/DD/YYYY format when the corporation ceased business operations if the corporation went out of business during, or on the last day of the corporation's tax year ending. Do not enter a date if the corporation ceased operations in Delaware and will continue to conduct business in another state.

Line 1.

Line 2.

Line 3.

Line 4.

Line 5.

Line 6.

Line 7.

Line 8.

Line 9. Subtract Line 7 from Line 4. If Line 7 is greater than Line 4, enter on Line 9(a) the TOTAL OVERPAYMENT available for refund and/or credit carryover. Enter on Line 9(b) the amount of REFUND REQUESTED. Enter on Line 9(c) the amount of credit CARRYOVER REQUESTED. The sum of Lines 9(b) and 9(c) must be equal to the amount entered on Line 9(a).