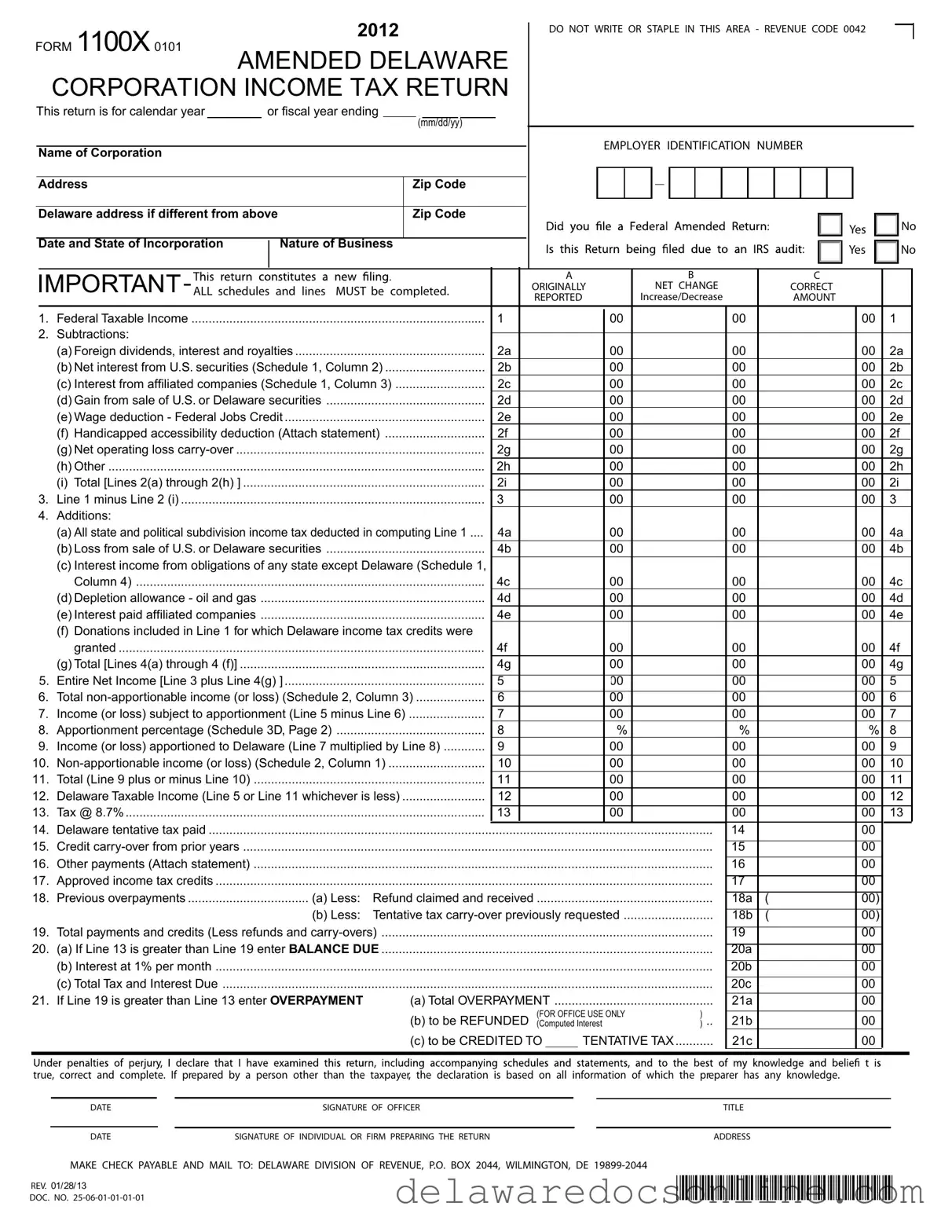

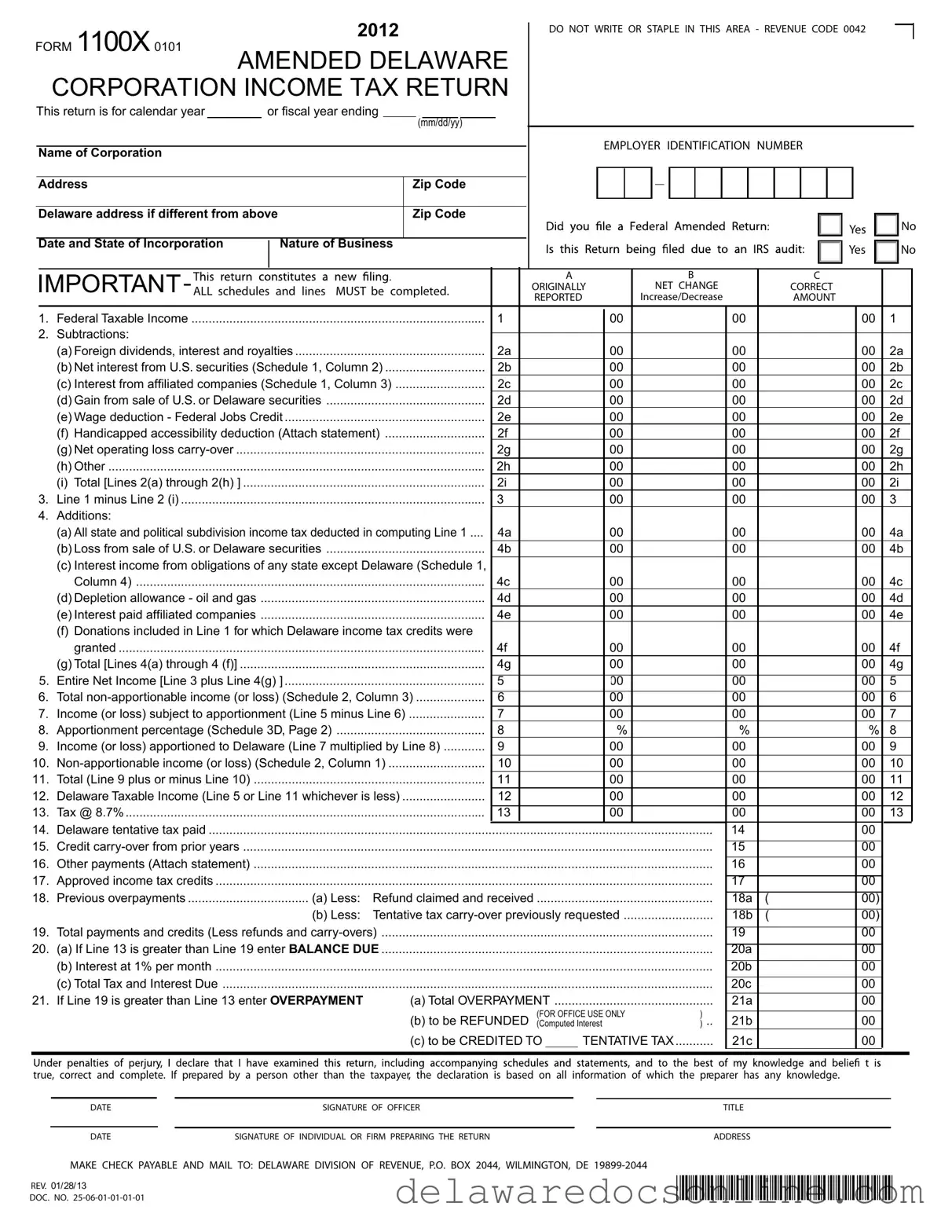

IMPORTANT-ALL schedules and lines MUST be completed. |

|

|

A |

|

|

|

|

B |

|

|

C |

|

|

|

|

ORIGINALLY |

|

|

NET CHANGE |

|

|

CORRECT |

|

|

|

|

|

|

|

|

|

|

REPORTED |

|

|

|

|

INCREASE/DECREASE |

|

|

AMOUNT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

Federal Taxable Income |

|

|

1 |

|

|

|

|

|

00 |

|

|

00 |

|

|

00 |

|

1 |

|

|

2. |

Subtractions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) Foreign dividends, interest and royalties |

|

|

2a |

|

|

00 |

|

|

00 |

|

|

00 |

|

2a |

|

|

|

|

(b) Net interest from U.S. securities (Schedule 1, Column 2) |

2b |

|

|

00 |

|

|

00 |

|

|

00 |

|

2b |

|

|

|

|

(c) Interest from affiliated companies (Schedule 1, Column 3) |

2c |

|

|

00 |

|

|

00 |

|

|

00 |

|

2c |

|

|

|

|

(d) Gain from sale of U.S. or Delaware securities |

|

2d |

|

|

00 |

|

|

00 |

|

|

00 |

|

2d |

|

|

|

|

(e) Wage deduction - Federal Jobs Credit |

|

|

2e |

|

|

00 |

|

|

00 |

|

|

00 |

|

2e |

|

|

|

|

(f) Handicapped accessibility deduction (Attach statement) |

2f |

|

|

00 |

|

|

00 |

|

|

00 |

|

2f |

|

|

|

|

(g) Net operating loss carry-over |

|

|

2g |

|

|

00 |

|

|

00 |

|

|

00 |

|

2g |

|

|

|

|

(h) Other |

|

|

2h |

|

|

00 |

|

|

00 |

|

|

00 |

|

2h |

|

|

|

|

(i) Total [Lines 2(a) through 2(h) ] |

|

|

2i |

|

|

00 |

|

|

00 |

|

|

00 |

|

2i |

|

|

3. Line 1 minus Line 2 (i) |

|

|

3 |

|

|

|

|

|

00 |

|

|

00 |

|

|

00 |

|

3 |

|

|

4. |

Additions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) All state and political subdivision income tax deducted in computing Line 1 .... |

4a |

|

|

00 |

|

|

00 |

|

|

00 |

|

4a |

|

|

|

|

(b) Loss from sale of U.S. or Delaware securities |

|

4b |

|

|

00 |

|

|

00 |

|

|

00 |

|

4b |

|

|

|

|

(c) Interest income from obligations of any state except Delaware (Schedule 1, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Column 4) |

|

|

4c |

|

|

00 |

|

|

00 |

|

|

00 |

|

4c |

|

|

|

|

(d) Depletion allowance - oil and gas |

|

|

4d |

|

|

00 |

|

|

00 |

|

|

00 |

|

4d |

|

|

|

|

(e) Interest paid affiliated companies |

|

|

4e |

|

|

00 |

|

|

00 |

|

|

00 |

|

4e |

|

|

|

|

(f) Donations included in Line 1 for which Delaware income tax credits were |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

granted |

|

|

4f |

|

|

00 |

|

|

00 |

|

|

00 |

|

4f |

|

|

|

|

(g) Total [Lines 4(a) through 4 (f)] |

|

|

4g |

|

|

00 |

|

|

00 |

|

|

00 |

|

4g |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

Entire Net Income [Line 3 plus Line 4(g) ] |

|

|

5 |

|

|

|

|

|

|

00 |

|

|

00 |

|

|

00 |

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. Total non-apportionable income (or loss) (Schedule 2, Column 3) |

6 |

|

|

|

|

|

00 |

|

|

00 |

|

|

00 |

|

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7. Income (or loss) subject to apportionment (Line 5 minus Line 6) |

7 |

|

|

|

|

|

00 |

|

|

00 |

|

|

00 |

|

7 |

|

|

8. Apportionment percentage (Schedule 3D, Page 2) |

|

8 |

|

|

|

|

|

% |

|

|

% |

|

|

% |

|

8 |

|

|

9. Income (or loss) apportioned to Delaware (Line 7 multiplied by Line 8) |

9 |

|

|

|

|

|

00 |

|

|

00 |

|

|

00 |

|

9 |

|

|

10. |

Non-apportionable income (or loss) (Schedule 2, Column 1) |

10 |

|

|

|

|

|

00 |

|

|

00 |

|

|

00 |

|

10 |

|

|

11. |

Total (Line 9 plus or minus Line 10) |

|

|

11 |

|

|

|

|

|

00 |

|

|

00 |

|

|

00 |

|

11 |

|

|

12. |

Delaware Taxable Income (Line 5 or Line 11 whichever is less) |

12 |

|

|

|

|

|

00 |

|

|

00 |

|

|

00 |

|

12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13. |

Tax @ 8.7% |

|

|

13 |

|

|

|

|

|

00 |

|

|

00 |

|

|

00 |

|

13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14. |

Delaware tentative tax paid |

|

|

|

|

|

|

|

|

|

|

|

|

14 |

|

|

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15. |

Credit carry-over from prior years |

|

|

|

|

|

|

|

|

|

|

|

|

15 |

|

|

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16. |

Other payments (Attach statement) |

|

|

|

|

|

|

|

|

|

|

|

|

16 |

|

|

00 |

|

|

|

|

17. |

Approved income tax credits |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17 |

|

|

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18. |

Previous overpayments |

(a) Less: |

Refund claimed and received |

|

|

|

|

|

18a |

( |

|

00) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(b) Less: |

Tentative tax carry-over previously requested |

|

18b |

( |

|

00) |

|

|

|

|

19. |

Total payments and credits (Less refunds and carry-overs) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19 |

|

|

00 |

|

|

|

|

20. |

(a) If Line 13 is greater than Line 19 enter BALANCE DUE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20a |

|

|

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(b) Interest at 1% per month |

|

|

|

|

|

|

|

|

|

|

|

|

20b |

|

|

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(c) Total Tax and Interest Due |

|

|

|

|

|

|

|

|

|

|

|

|

20c |

|

|

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21. |

If Line 19 is greater than Line 13 enter OVERPAYMENT |

(a) Total OVERPAYMENT |

|

|

|

|

|

21a |

|

|

00 |

|

|

|

|

|

|

|

|

|

|

|

(FOR OFFICE USE ONLY |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

(b) to be REFUNDED |

21b |

|

|

00 |

|

|

|

|

|

|

|

|

....................................................(Computed Interest |

|

|

) |

|

|

|

|

|

|

|

|

|

|

|

(c) to be CREDITED TO |

TENTATIVE TAX |

21c |

|

|

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

true, correct and complete. If prepared by a person other than the taxpayer, the declaration is based on all information of which the preparer has any knowledge.

MAKE CHECK PAYABLE AND MAIL TO: DELAWARE DIVISION OF REVENUE, P.O. BOX 2044, WILMINGTON, DE 19899-2044