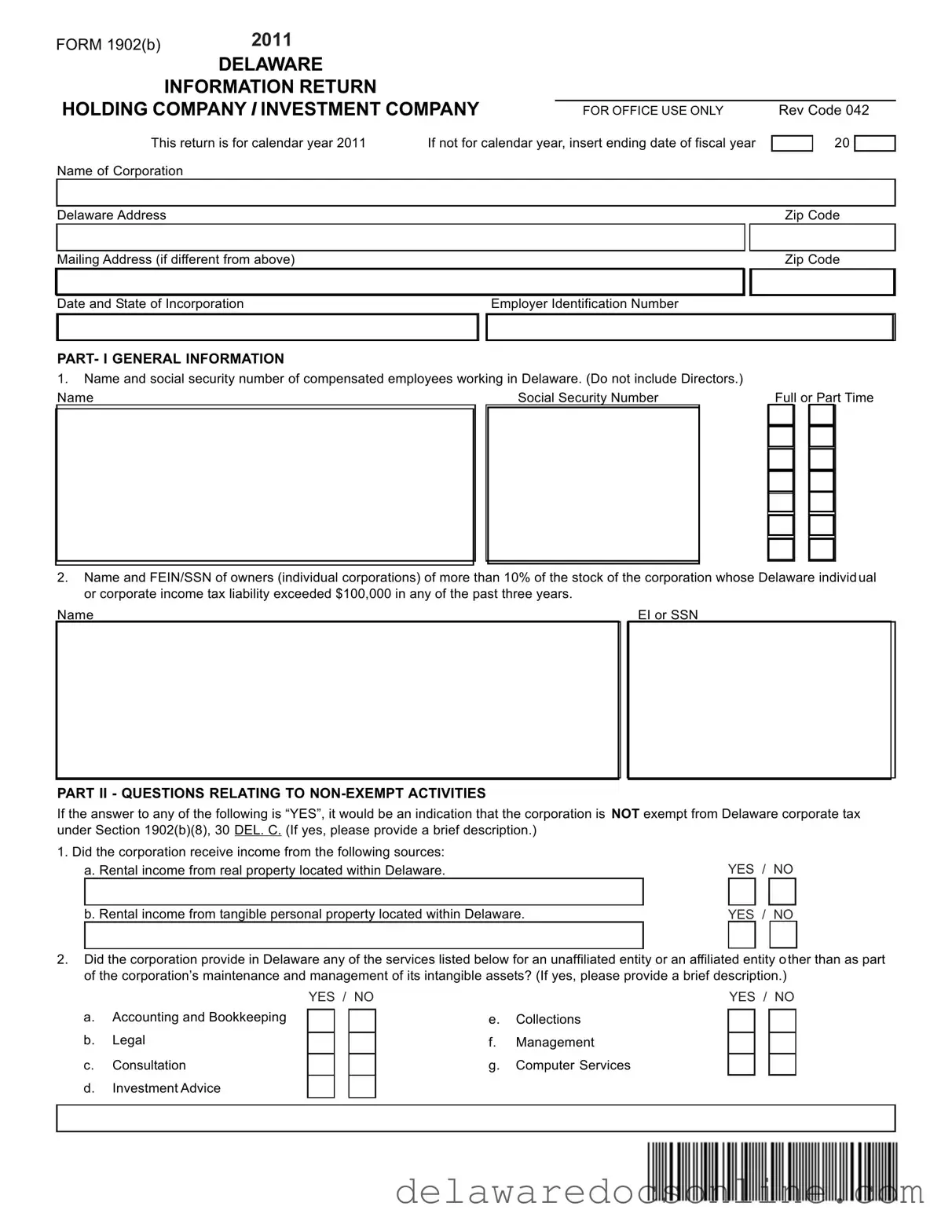

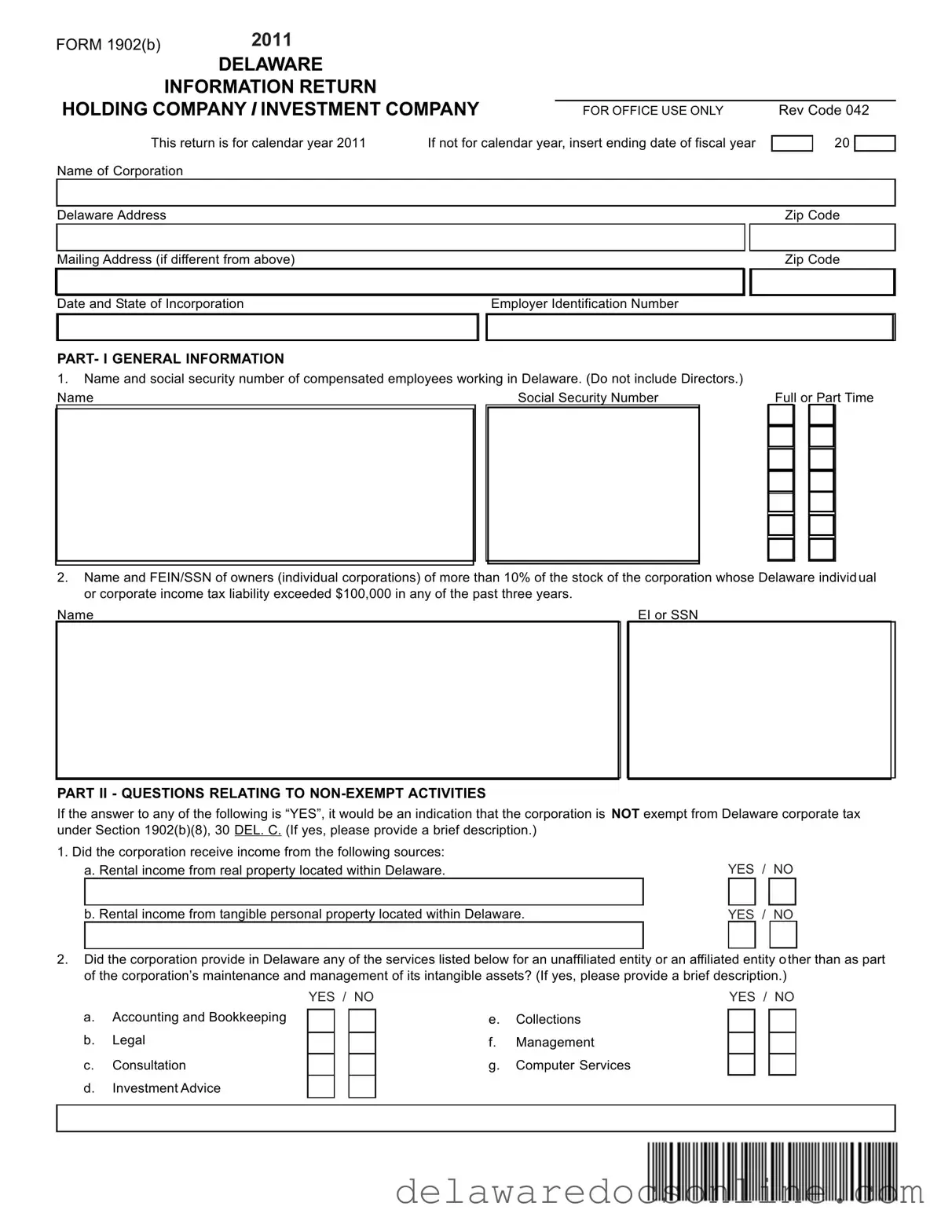

FORM 1902(b) |

2011 |

|

|

|

|

|

|

DELAWARE |

|

|

|

INFORMATION RETURN |

|

|

HOLDING COMPANY I INVESTMENT COMPANY |

FOR OFFICE USE ONLY |

This return is for calendar year 2011 |

If not for calendar year, insert ending date of fiscal year |

Name of Corporation |

|

|

Delaware Address |

|

|

|

Zip Code |

|

|

|

|

|

Mailing Address (if different from above) |

|

|

|

Zip Code |

|

|

|

|

|

Date and State of Incorporation |

|

Employer Identification Number |

|

|

|

|

|

|

|

|

|

|

PART- I GENERAL INFORMATION

1.Name and social security number of compensated employees working in Delaware. (Do not include Directors.)

Name |

|

Social Security Number |

Full or Part Time |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2.Name and FEIN/SSN of owners (individual corporations) of more than 10% of the stock of the corporation whose Delaware individual or corporate income tax liability exceeded $100,000 in any of the past three years.

PART II - QUESTIONS RELATING TO NON-EXEMPT ACTIVITIES

If the answer to any of the following is “YES”, it would be an indication that the corporation is NOT exempt from Delaware corporate tax under Section 1902(b)(8), 30 DEL. C. (If yes, please provide a brief description.)

1. Did the corporation receive income from the following sources: |

|

|

|

|

|

a. Rental income from real property located within Delaware. |

|

YES |

/ |

NO |

|

|

|

|

|

|

|

b. Rental income from tangible personal property located within Delaware. |

|

YES |

/ |

NO |

|

|

|

|

|

|

2.Did the corporation provide in Delaware any of the services listed below for an unaffiliated entity or an affiliated entity other than as part of the corporation’s maintenance and management of its intangible assets? (If yes, please provide a brief description.)

YES / NO

a.Accounting and Bookkeeping

b.Legal

c.Consultation

d.Investment Advice

YES / NO

e.Collections

f.Management

g.Computer Services

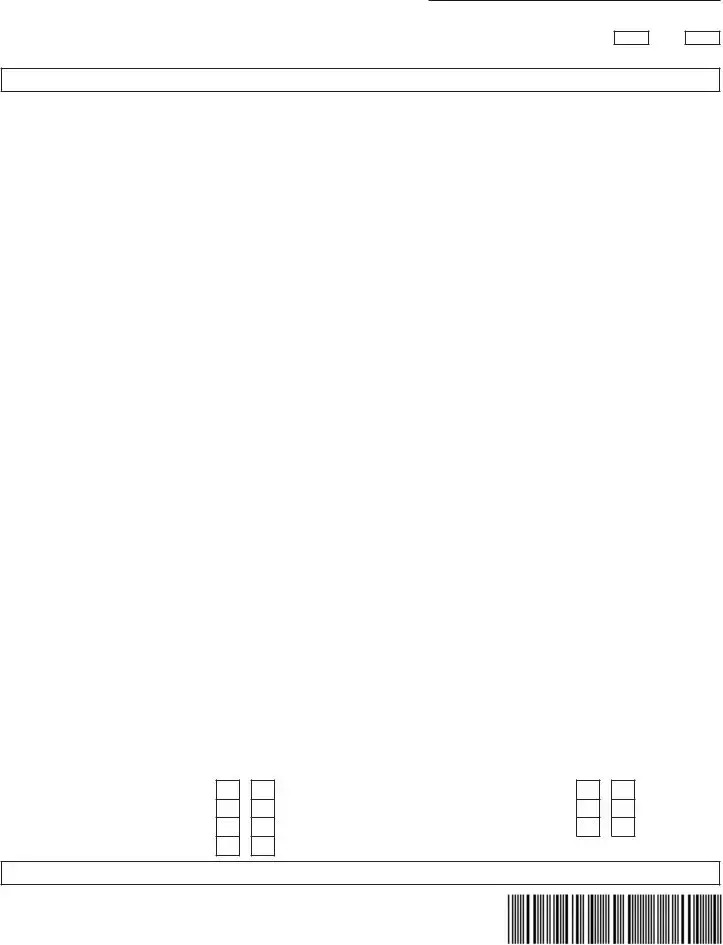

PART III - QUESTIONS RELATING TO EXEMPT ACTIVITIES

If the answer to any of the following is “YES”, it would be an indication that the corporation is exempt from Delaware corporat e tax under Section 1902(b)(8), 30 DEL C. (If yes, please provide a brief description.)

1.Did the corporation directly or indirectly receive income from any one of the following sources?Please check the appropriate box for each source of income and, for each “yes” response where the income received isin excessof $1 million, provide a description of the activity performed in Delaware with regard to such income.

a. |

Interest on notes secured by real estate mortgages. |

|

YES |

/ |

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

b. |

Interest on all other debt obligations. |

|

YES |

/ |

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

c. |

Dividends. |

|

YES |

/ |

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

d. |

Patents, patent applications, trademarks, trade names and know-how. |

|

YES |

/ |

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

e. |

Gain on the sale of intangible investments. |

|

YES |

/ |

NO |

|

|

|

|

|

|

|

|

|

|

|

|

f. Rental income from real property located outside of Delaware. |

|

YES |

/ |

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

g. |

Rental income from tangible personal property located outside of Delaware. |

|

YES |

/ |

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2.Is the corporation engaged in business activities outside of Delaware other than described

in Question 1 above? (If yes, please describe.) |

|

YES / NO |

|

|

|

|

|

|

|

|

|

|

PART IV - ADDITIONAL INFORMATION |

YES / NO |

Did the corporation have any source of income other than the sources of income described in Parts II and III above? (If yes, please describe the source of income and the activity in Delaware relating to it.)

Under penalties of perjury, I declare that I have examined this return and statements, and believe it is true, correct and complete.

INSTRUCTIONS FOR FORM 1902(B)

INFORMATION RETURN FOR HOLDING COMPANY/INVESTMENT COMPANY

GENERAL INSTRUCTIONS

CORPORATIONS REQUIRED TO FILE RETURNS

Under 30 Del. C., §1904(g), an Annual Information Return may be required of each corporation claiming exemption from Delaware corporate income tax under 30 Del. C., §1902(b)(8) which provides an exemption for “Corporations whose activities within this State are confined to the maintenance and management of their intangible investments and the collection and distribution of the income from such investments or from tangible property physically located outside this State. For purposes of this paragraph, ‘intangible investments’ shall include, without limitation, investments in stocks, bonds, notes, and other debt obligations (including debt obligations of affiliated corporations), patents, patent applications, trademarks, trade names and similar types of intangible assets.” Form 1902(b), Information Return for Holding Company/Investment Company, must be filed annually by corporations claiming exemption from corporate taxation under Section 1902(b)(8) of Title 30 of the Delaware Code.

PERIOD COVERED BY RETURN

The taxable year ending date of a corporation required to file Form 1902(b) Information Return shall be the same as it is for purposes of computing its federal income tax.

WHEN TO FILE AND EXTENSIONS

Form 1902(b) Information Return must be filed on or before the first day of the fourth month following the end of the taxable year. A request for an automatic extension of six months to the Internal Revenue Service will automatically extend the filing date of the Delaware return by six months. If no federal extension was requested, an extension of time for filing may be made by a letter on or before the due date. Copies of extensions granted (Federal Form 7004 or Delaware Division of Revenue Approval Letter) must be attached to the return when filed. Please detach and mail Form 1902(b), Information Return, to the Division of Revenue, 820 N. French Street, P.O. Box 2044, Wilmington, Delaware 19899-2044.

PART 1 - GENERAL INFORMATION

LINE 1 - COMPENSATED DELAWARE EMPLOYEES

Enter on Line 1 the names and social security number(s) of individuals employed by the filing corporation within Delaware (do not include Directors). Please also indicate whether employed on a full or part time basis. If additional space is needed, please attach a separate schedule.

LINE 2 - PERSONS OWNING MORE THAN 10% OF THE STOCK OF THE CORPORATION

Enter on Line 2 the name and Federal Employer Identification Number or Social Security Number of owners (individual partnership or corporation) of more than 10% of the outstanding stock of the corporation whose Delaware individual or corporate income tax liability exceeded $100,000 in any of the past three years. If additional space is needed, please attach a separate schedule.

SPECIFIC INSTRUCTIONS

PART II - QUESTIONS RELATING TO NON-EXEMPT ACTIVITIES

If the answer to any of the following questions is yes, it would be an indication that the corporation is NOT exempt from Delaware Corporate income tax under 30 Del. C. §1902(b)(8).

1.SOURCES OF INCOME. Did the corporation receive rental income from real property and/or tangible personal property located within Delaware? Please check appropriate box for each source of income and provide a description of the activities performed within Delaware for each “yes” box.

2.SERVICES PROVIDED. Did the corporation provide in Delaware any of the services listed for an unaffiliated entity or an affiliated entity other than as part of the corporation’s maintenance and management of its intangible assets? Please check appropriate box for each service and provide a description of the service performed within Delaware for each “yes” box.

PART III - QUESTIONS RELATING TO EXEMPT ACTIVITIES

If the answer to any of the following is “yes”, it would be an indication that the corporation is exempt from Delaware corporate income tax under §1902(b)(8), 30 Del. C.

1.SOURCES OF INCOME WITHIN DELAWARE. Did the corporation directly or indirectly receive income from anyone of the sources listed? Please check appropriate box for each source of income and, for each “yes” response where the income received is in excess of $1 million, provide a description of the activity performed in Delaware in the space provided.

2.SOURCES OF INCOME WITHOUT DELAWARE. Is the corporation engaged in business activities outside of Delaware other than those described in Question 1 above? If yes, please provide a brief description in the space provided.

PART IV - ADDITIONAL INFORMATION

Did the corporation have any sources of income other than the sources of income described in Parts II and III above? If yes, please describe the source of income and the activity in Delaware relating to it in the space provided.

SIGNATURE

Please sign and date this return indicating the title of the officer or designee signing this return, detach Form 1902(b) and mail to the Division of Revenue, 820 N. French Street, P.O. Box 2044, Wilmington, Delaware 19899-2044.