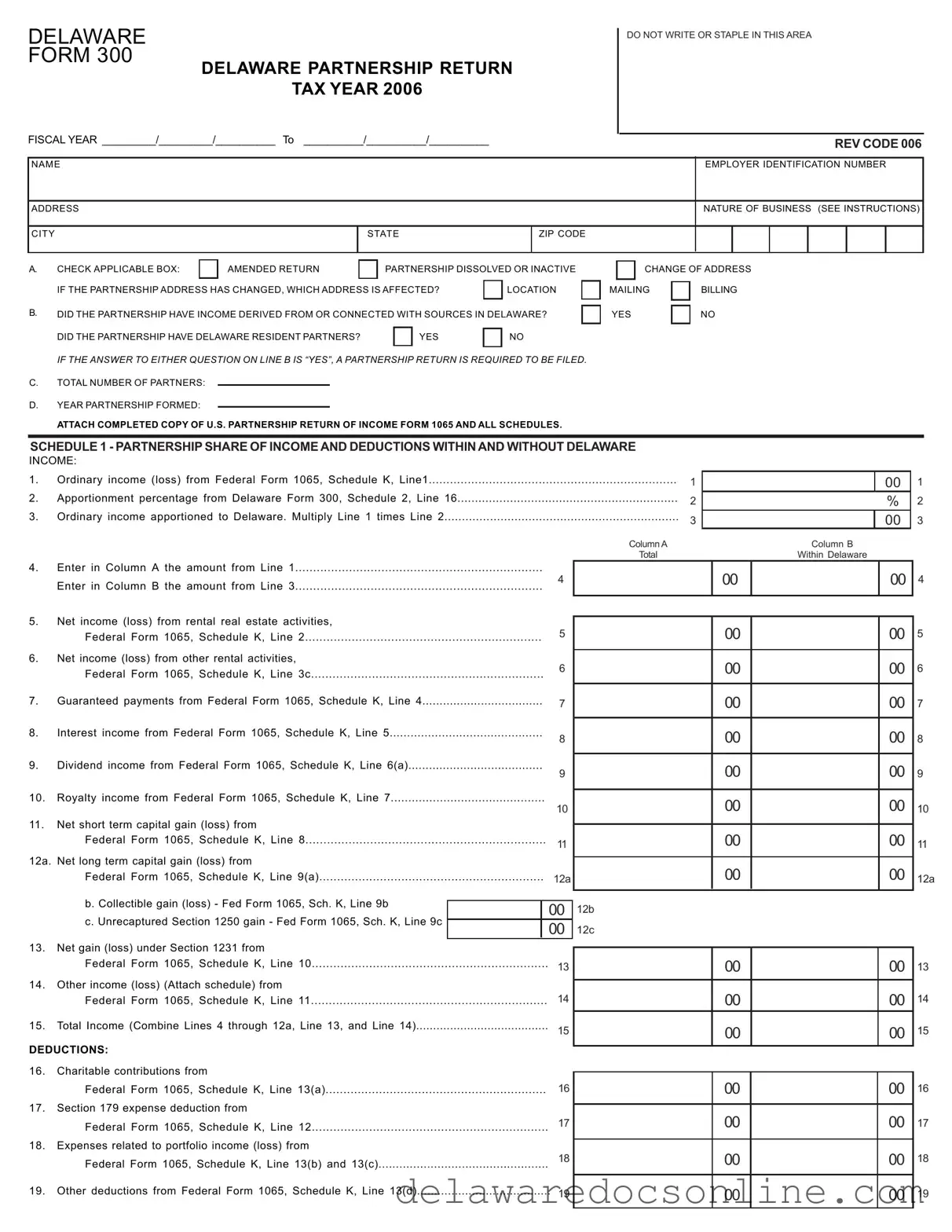

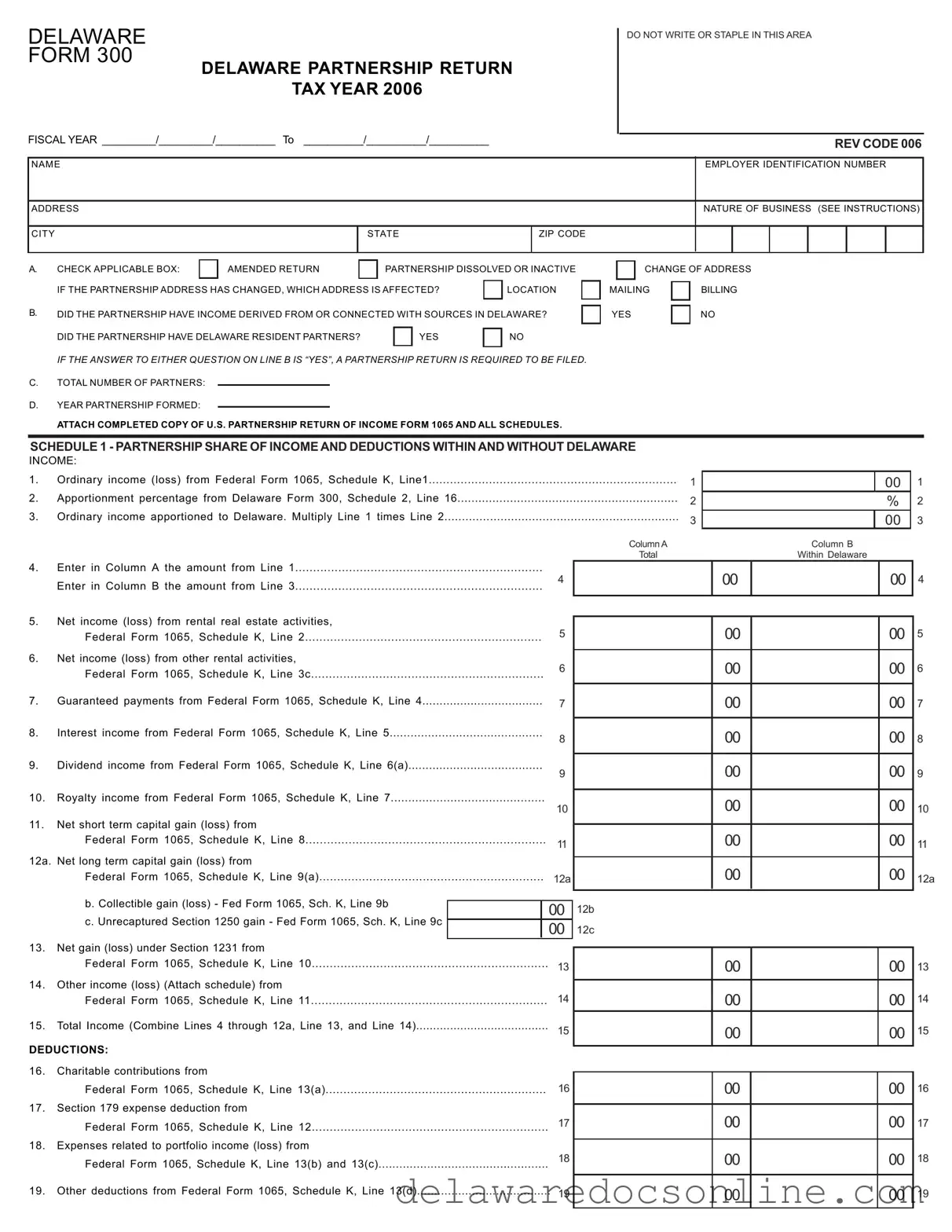

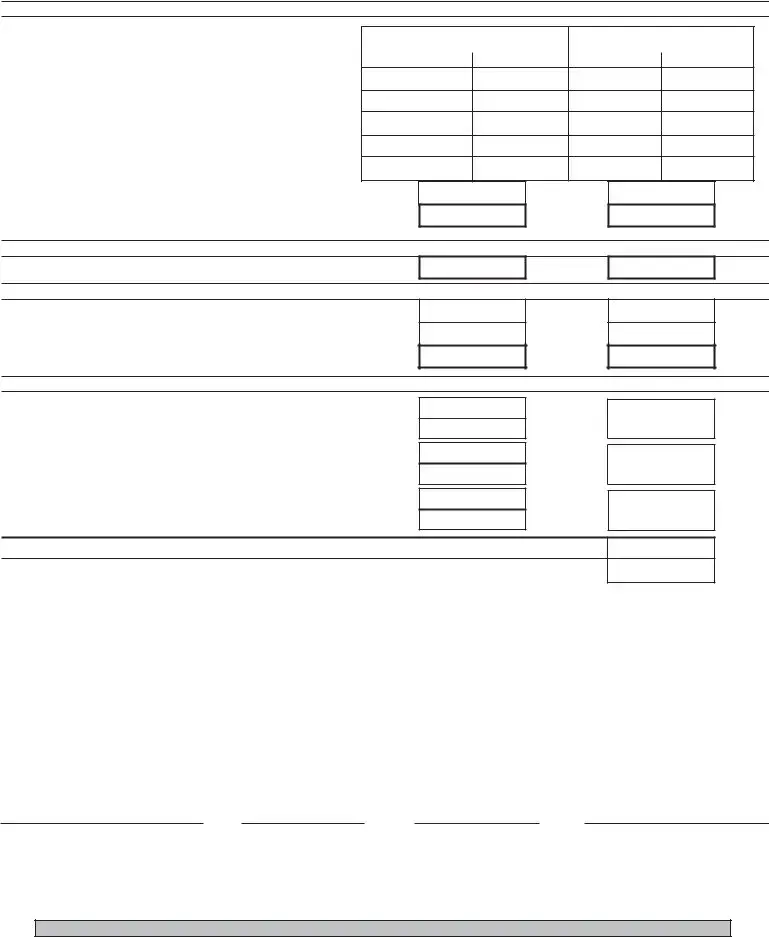

SCHEDULE 2 - APPORTIONMENT PERCENTAGE: COMPLETE ONLY IF PARTNERSHIP HAS INCOME DERIVED FROM OR CONNECTED WITH SOURCES IN DELAWARE AND AT LEAST ONE OTHER STATE AND IF IT HAS ONE OR MORE PARTNERS WHO ARE NOT RESIDENTS IN DELAWARE.

SECTION A - GROSS REAL AND TANGIBLE PERSONAL PROPERTY

COLUMN A |

|

COLUMN B |

Delaware Sourced |

|

Total Sourced (All Sources) |

Beginning of Year |

End of Year |

Beginning of Year |

End of Year |

1.Total real and tangible property owned..............................................................

2.Real tangible property rented (eight times annual rent paid).................................

3.Total (Combine Lines 1 and 2).........................................................................

4.Less: value at original cost of real and tangible property (see instructions)...........

5.Net Values (Subtract Line 4 from Line 3)..........................................................

6. |

Total (Combine Line 5 Beginning and End of Year Totals) |

6 |

7. |

Average values. (Divide Line 6 by 2) |

7 |

SECTION B - WAGES, SALARIES,AND OTHER COMPENSATION PAID ORACCRUED TO EMPLOYEES

8. Wages, salaries and other compensation of all employees....................................................

SECTION C - GROSS RECEIPTS SUBJECT TO APPORTIONMENT

9.Gross receipts from sales of tangible personal property........................................................

10.Gross income from other sources (see attachment)............................................................

11.Total..............................................................................................................................

SECTION D - DETERMINATION OF APPORTIONMENT PERCENTAGES

12a. Enter amount from Column A, Line 7..............................................................................

=

12b. Enter amount from Column B, Line 7..............................................................................

13a. Enter amount from Column A, Line 8..............................................................................

=

13b. Enter amount from Column B. Line 8..............................................................................

14a. Enter amount from Column A, Line 11.............................................................................

=

14b. Enter amount from Column B, Line 11.............................................................................

15.Total (Combine Apportionment Percentages on Lines 12, 13 and 14)

16.Apportionment percentage (see specific instructions)............................................................................................................................................................................................................................

12a

12b

13a

13b

14a

14b

15

16

UNDER PENALTIES OF PERJURY, I DECLARE THAT I HAVE EXAMINED THIS RETURN, INCLUDING ACCOMPANYING SCHEDULES AND STATEMENTS, AND TO THE BEST OF MY KNOWLEDGE AND BELIEF IT IS TRUE, CORRECT, AND COMPLETE. IF PREPARED BY A PERSON OTHER THAN TAXPAYER, THIS DECLARATION IS BASED ON ALL INFORMATION OF WHICH HE/SHE HAS ANY KNOWLEDGE.

SIGNATURE OF PARTNER |

DATE |

|

TELEPHONE NUMBER |

|

E-MAIL ADDRESS |

|

|

|

|

|

|

|

SIGNATURE OF PREPARER |

DATE |

|

TELEPHONE NUMBER |

|

PRINT NAME OF PREPARER |

|

|

|

|

|

|

PREPARER ADDRESS (STREET, CITY, STATE & ZIP CODE) |

|

|

|

|

PREPARER EIN/SSN/PTIN |

MAIL TO: DIVISION OF REVENUE, P.O. BOX 8703, WILMINGTON, DELAWARE 19899-8703

(Revised 01/22/07)