Fill Out Your Delaware 329 Form

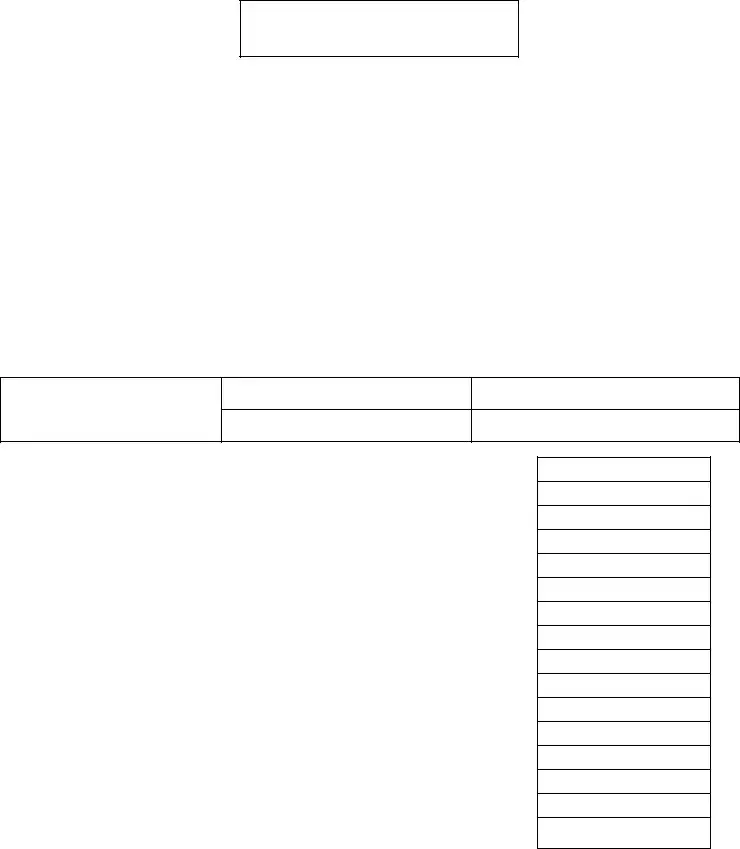

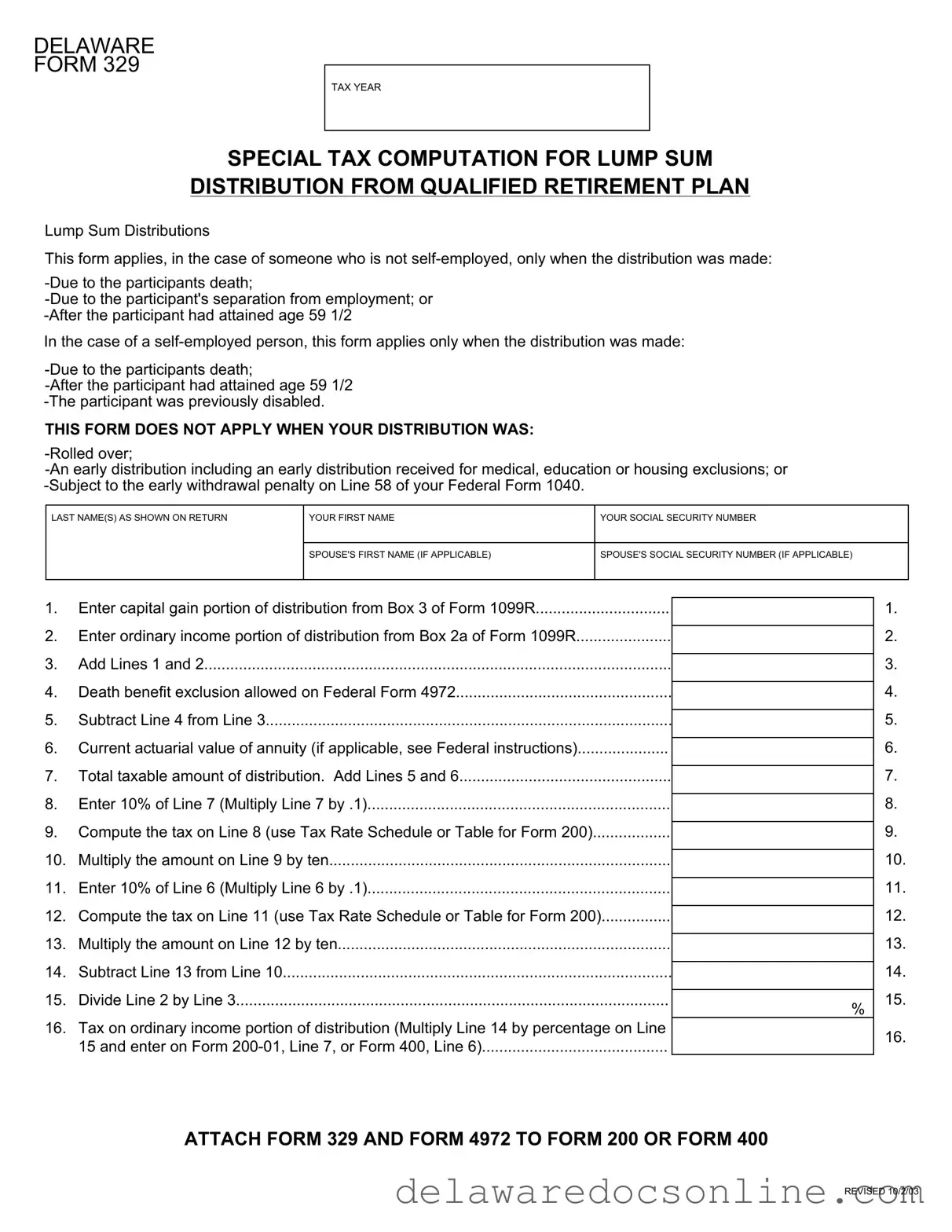

The Delaware Form 329 is a tax form used to compute special taxes for lump sum distributions from qualified retirement plans. It is specifically designed for individuals who have received distributions under certain conditions, such as death, separation from employment, or reaching age 59 ½. Understanding how to properly complete this form is essential for ensuring accurate tax reporting and compliance.

Make Your Delaware 329 Now

Fill Out Your Delaware 329 Form

Make Your Delaware 329 Now

Make Your Delaware 329 Now

or

⇓ PDF File

Need speed? Complete the form now

Edit, save, download — finish Delaware 329 online with ease.