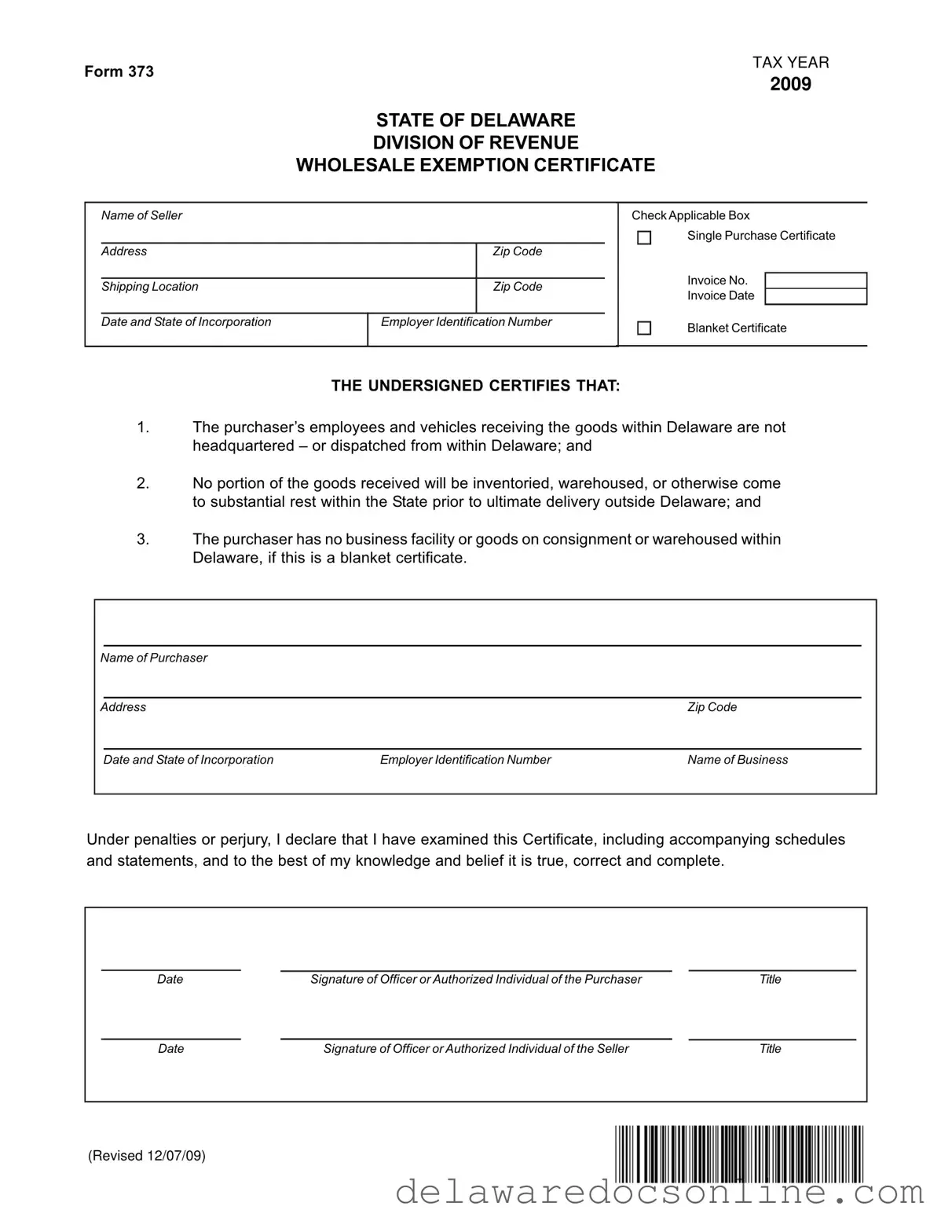

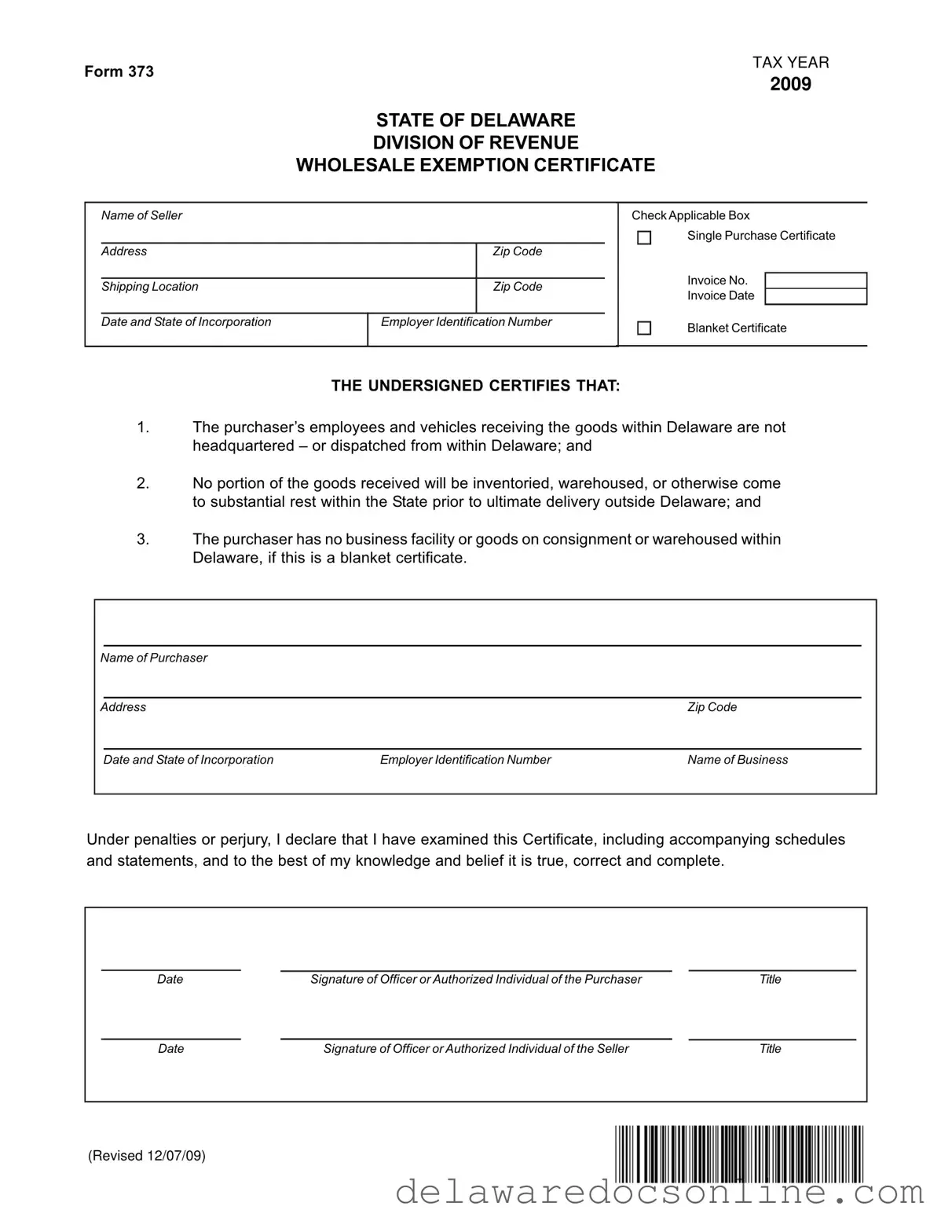

TAX YEAR

2009

INSTRUCTIONS FOR FORM 373 WHOLESALE EXEMPTION CERTIFICATE

Form 373 - Wholesale Exemption Certificate-is to be used to substantiate exempt sales to out of state purchasers which are picked up in Delaware. Sales made to out of state purchasers who pickup the goods in Delaware for subsequent delivery and consumption outside this state are exempt from the wholesale gross receipts tax.

Form 373 - Wholesale Exemption Certificate-must be completed to document such exempt sales and must be completed prior to or concurrent with the sale. Form 373 must be completed by the seller with all pertinent information and must contain the signature of an officer or authorized individual attesting to the accuracy of the information relating to the purchaser. A purchaser’s exemption certificate does NOT extend to any of its subordinate or affiliated entities or officers or employees of the purchaser. When making purchases, subordinate entities may NOT use an exemption claimed by a parent or affiliated organization.

Form 373 may be used to substantiate a single sale or multiple sales to the same wholesaler. Check the applicable box to indicate if Form 373 is a single purchase or blanket certificate.

Form 373 must contain the name, mailing address, shipping location, the state and date of incorporation and employer identification number of the seller. The seller must check the applicable box to indicate the type of exemption claimed, and in the case of a single purchase, the invoice number and date. An officer or authorized individual must sign and date Form 373 certifying that the statements relating to the seller contained on the form are accurate and correct.

Form 373 must contain the name, address, date and state of incorporation, federal employer identification number and nature of business of the purchaser. The purchase orders on which an exemption from the tax is claimed, by reason of this certificate, must contain the name and address of the destination if different from the purchaser’s address. An officer or authorized individual must sign and date Form 373 certifying that the statements relating to the purchaser contained on the form are accurate and correct.

Ablanket exemption certificate may be used to substantiate multiple exempt sales to the same out-of-state purchaser provided the seller maintains a duly executed exemption certificate dated within one year prior to the date of the sale for which exemption is claimed. Each subsequent sales slip or invoice to which the blanket certificate applies must contain a notation that an exemption is being claimed. Failure by the seller to maintain a list of valid exemption certificates and to note on each sales invoice that an exemption is being claimed will cause the sale to be taxable.

The Director of Revenue has the right to review exempt certificates to request information pertaining to the nature of the sale and organizational structure of the purchaser. Failure to submit the information can result in the revocation of the exemption. The tax records, invoices or accounting records of the wholesaler must be adequately maintained and accessible to Delaware Division of Revenue personnel to enable efficient matching to a true, correct and complete wholesaler exemption certificate(s) of all sales to which the seller takes an exemption from tax.

Failure by a wholesale licensee to pay tax in reliance on an untrue or incomplete exemption certificate furnished by a purchaser does not relieve the wholesaler of liability for the tax or for penalty or interest with regard to such tax.

Vendors must retain Form 373 for a period of three years from the end of the calendar year in which the sale occurs. Additional copies of Form 373 may be obtained from the Division of Revenue. This form may be reproduced without prior permission from the Division of Revenue.

Doc. No. 25-06-02-85-08-01 - DR-373