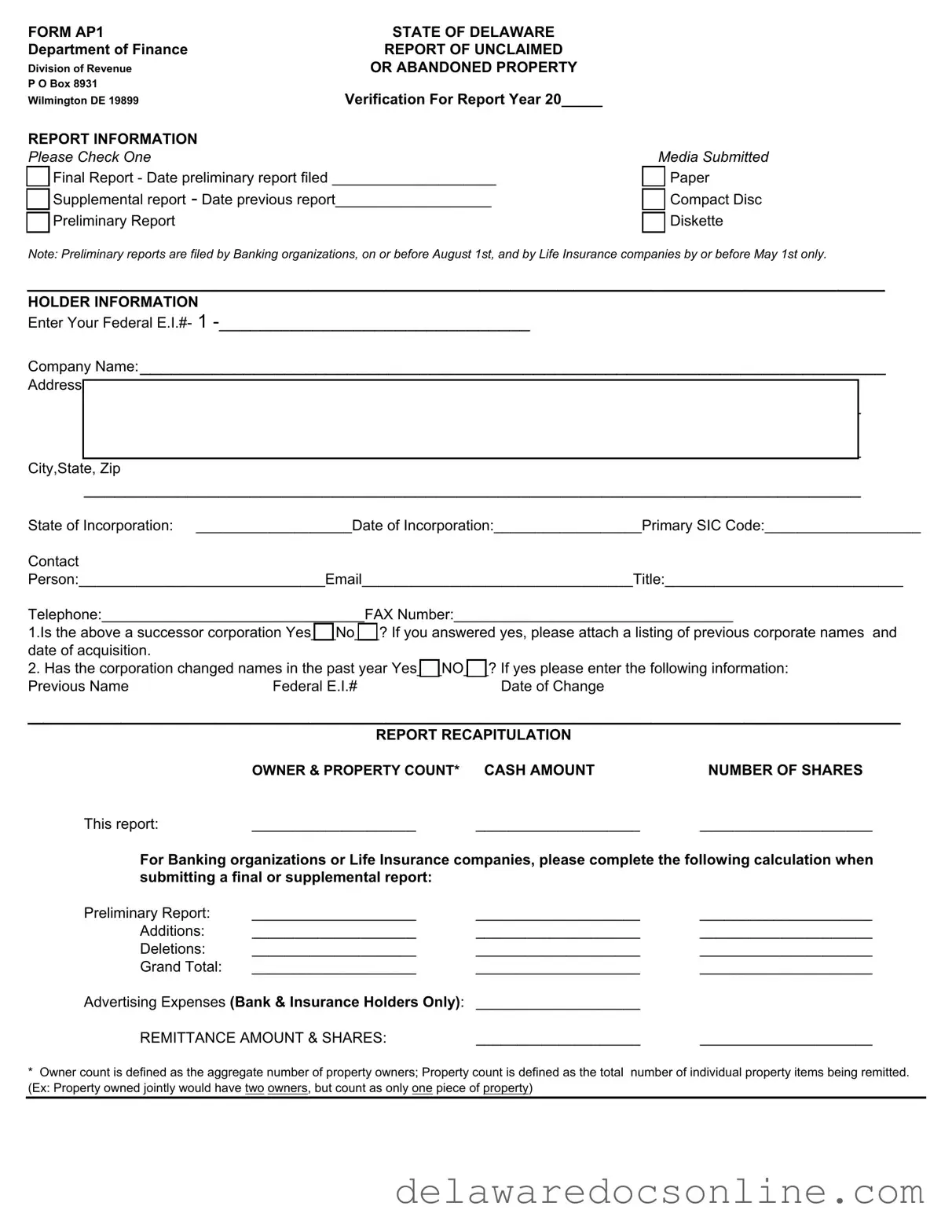

FORM AP1 |

STATE OF DELAWARE |

Department of Finance |

REPORT OF UNCLAIMED |

Division of Revenue |

OR ABANDONED PROPERTY |

P O Box 8931 |

|

Wilmington DE 19899 |

Verification For Report Year 20_____ |

REPORT INFORMATION

Please Check One

[] Final Report - Date preliminary report filed ____________________

[] Supplemental report - Date previous report___________________

[] Preliminary Report

Media Submitted

[] Paper

[] Compact Disc

[] Diskette

Note: Preliminary reports are filed by Banking organizations, on or before August 1st, and by Life Insurance companies by or before May 1st only.

_______________________________________________________

HOLDER INFORMATION

Enter Your Federal E.I.#- 1 -______________________________

Company Name:________________________________________________________________________

Address:

___________________________________________________________________________

___________________________________________________________________________

City,State, Zip

___________________________________________________________________________

State of Incorporation: ___________________Date of Incorporation:__________________Primary SIC Code:___________________

Contact

Person:______________________________Email_________________________________Title:_____________________________

Telephone:________________________________FAX Number:__________________________________

1.Is the above a successor corporation Yes___No___? If you answered yes, please attach a listing of previous corporate names and date of acquisition.

2. Has the corporation changed names in the past year Yes___NO___? If yes please enter the following information:

Previous NameFederal E.I.#Date of Change

________________________________________________________

|

REPORT RECAPITULATION |

|

|

OWNER & PROPERTY COUNT* |

CASH AMOUNT |

NUMBER OF SHARES |

This report: |

____________________ |

____________________ |

_____________________ |

For Banking organizations or Life Insurance companies, please complete the following calculation when |

submitting a final or supplemental report: |

|

|

Preliminary Report: |

____________________ |

____________________ |

_____________________ |

Additions: |

____________________ |

____________________ |

_____________________ |

Deletions: |

____________________ |

____________________ |

_____________________ |

Grand Total: |

____________________ |

____________________ |

_____________________ |

Advertising Expenses (Bank & Insurance Holders Only): ____________________ |

|

REMITTANCE AMOUNT & SHARES: |

____________________ |

_____________________ |

*Owner count is defined as the aggregate number of property owners; Property count is defined as the total number of individual property items being remitted. (Ex: Property owned jointly would have two owners, but count as only one piece of property)

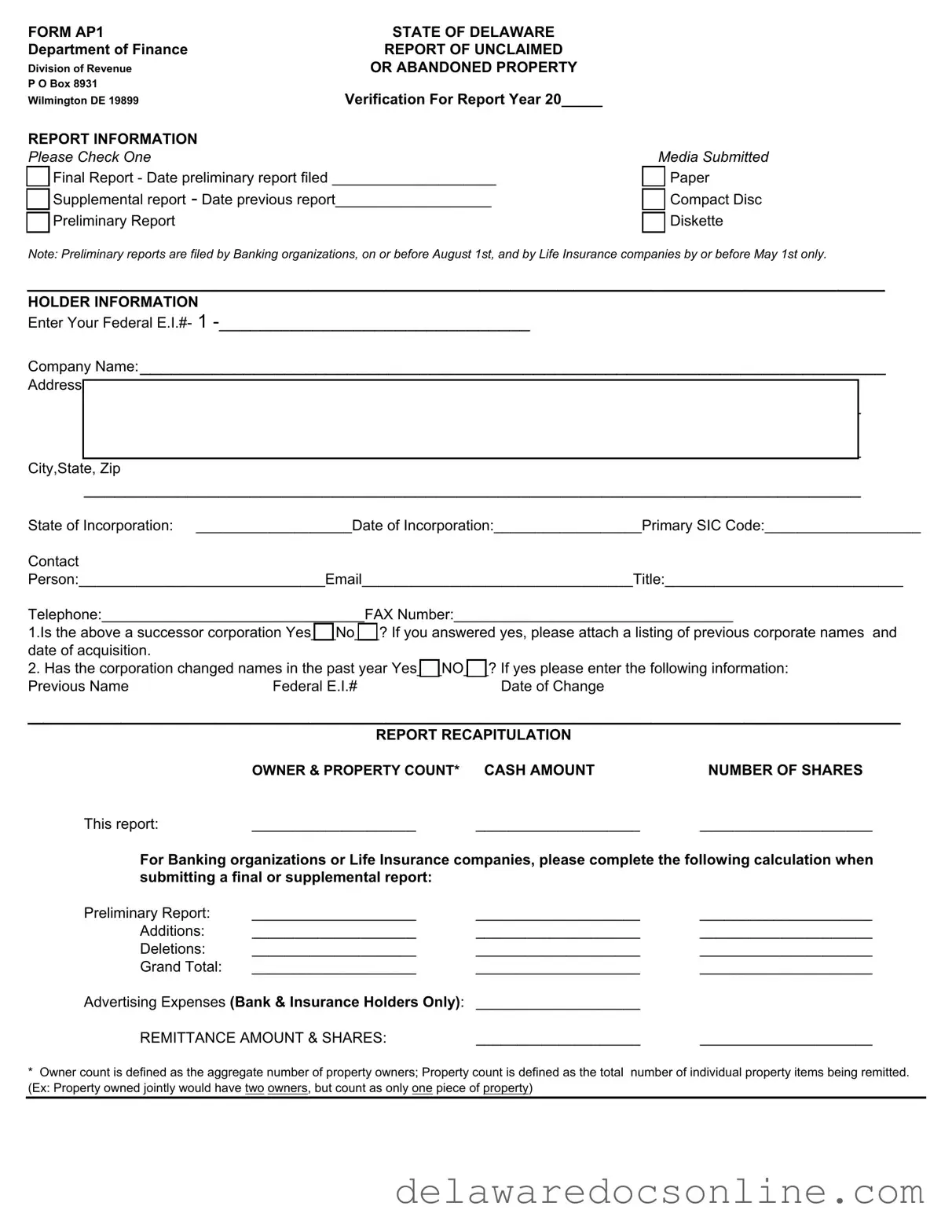

FORM AP1 |

STATE OF DELAWARE |

Department of Finance |

REPORT OF UNCLAIMED |

Division of Revenue |

OR ABANDONED PROPERTY |

P O Box 8931 |

|

Wilmington DE 19899 |

Verification For Report Year 20_____ |

HOLDER DELIVERY OF SECURITIES:

Holders delivering securities must provide account statements and documentation related to the State of Delaware Escheatment. Have securities been transferred to the State account: ______Yes ______ No

Are account statements and transfer documentation included with this report: ______Yes ______ No

_____________________________________________________________________________________

VERIFICATION

State of_________________________:

County of________________________: ss

I, ________________________________________ being first duly sworn, on oath depose and state that I have caused to be prepared and have

examined this report as to property presumed abandoned under the Delaware Unclaimed Property Law for the year ending as stated; that I am duly authorized by the holder to execute this report; and I believe that said report is true, correct and complete as of said date, excepting for such property as has ceased to be abandoned.

Signature__________________________________ Title________________________________________

Subscribed and sworn to before me this____________day of__________, 20_________.

DOCUMENT NO: 25-06/87/11/10

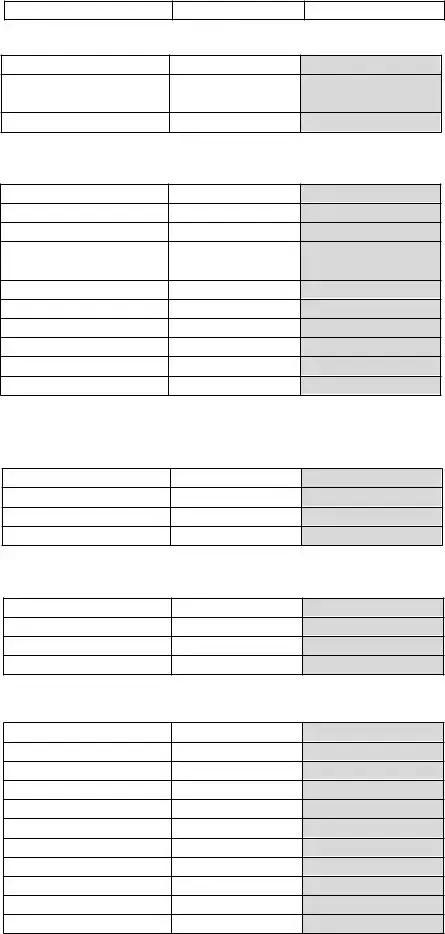

AP-1 CHECKLIST

# OWNERS / # PROP. |

$ REPORTED |

# SHARES |

ACCOUNT BALANCES

AC01 Checking Accounts

AC02 Savings Accounts

AC03 Matured CD or Savings Certs.

AC04 Christmas Club Accounts

AC05 Money on Deposit to Secure Funds

AC06 Security Deposits

AC07 Unidentified Deposits

AC08 Suspense Accounts

AC99 Aggregate

TOTAL

UNCASHED CHECKS

CK01 Cashiers Checks

CK02 Certified Checks

CK03 Registered Checks

CK04 Treasurers Checks

CK05 Drafts

CK06 Warrants

CK07 Money Orders

CK08 Travelers Checks

CK09 Foreign Exchange Checks

CK10 Expense Checks

CK11 Pension Checks

CK12 Credit Checks or Memos

CK13 Vendor Checks

CK14 Checks Written off to Income

CK15 Other Official Checks

CK16 CD Interest Checks

CK99 Aggregate

TOTAL

COURT DEPOSITS

CT01 Escrow Funds

CT02 Condemnation Awards

CT03 Missing Heirs’ Fund

CT04 Suspense Accounts

CT05 Other Court Deposits

CT99 Aggregate

TOTAL

EDUCATIONAL SAVINGS ACCOUNTS

CS01 Cash

CS02 Mutual Funds

CS03 Securities

TOTAL

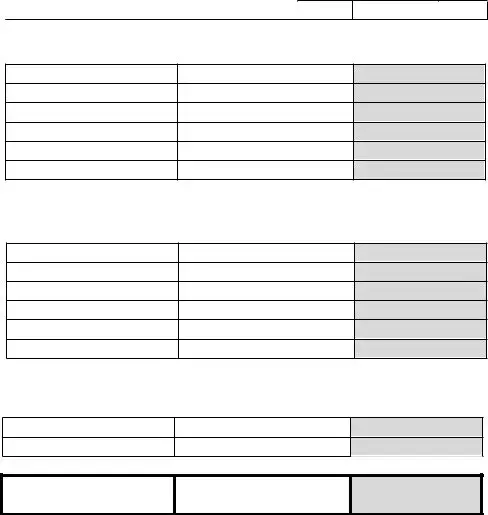

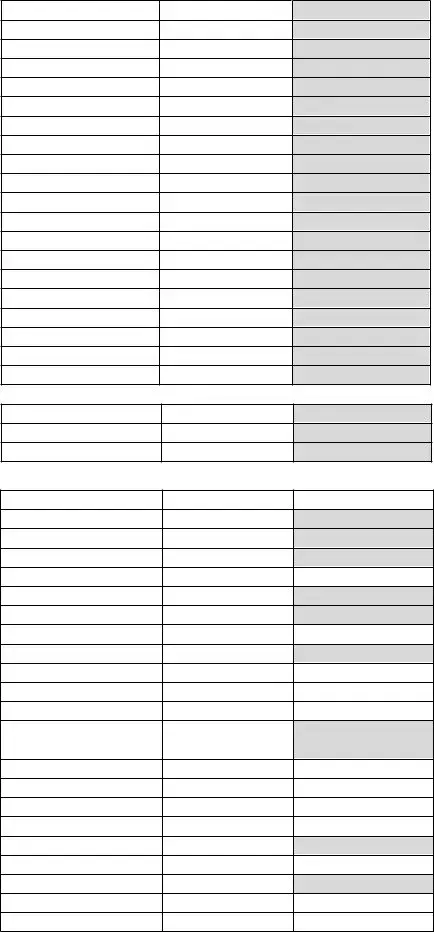

AP-1 CHECKLIST - CONTINUED

# OWNERS / # PROP.

HEALTH SAVINGS PLAN

HS01 Health Savings Account

HS02 Health Savings Account

Investment

TOTAL

INSURANCE

IN01 Indiv. Policy Benefits or Claims

IN02 Group Policy Benefits or Claims

IN03 Proceeds Due Beneficiaries

IN04 Proceeds From Matured Policies,

Endowments or Annuities

IN05 Premium Refunds

IN06 Unidentified Remittances

IN07 Other Amounts Due Under Policy

IN08 Agent Credit Balances

IN99 Aggregate

TOTAL

IRA - TRADITIONAL, SEP, SARSEP, AND SIMPLE

IR01 Cash

IR02 Mutual Funds

IR03 Securities

TOTAL

IRA - ROTH

IR05 Cash

IR06 Mutual Funds

IR07 Securities

TOTAL

MINERAL PROCEEDS & INTERESTS

MI01 Net Revenue Interest

MI02 Royalties

MI03 Overriding Royalties

MI04 Production Payments

MI05 Working Interest

MI06 Bonuses

MI07 Delay Rentals

MI08 Shut-in Royalties

MI09 Minimum Royalties

MI99 Aggregate

TOTAL

Funds for Liquadition/Redemption

(Accounts Rec.)

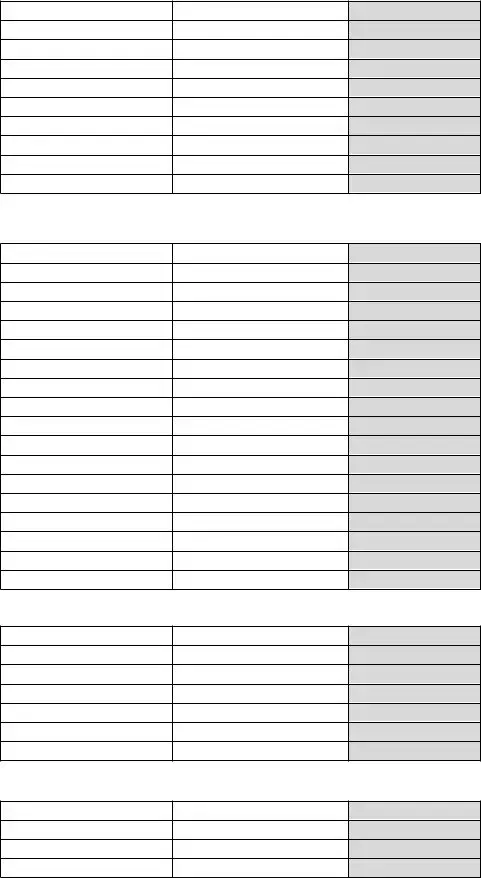

AP-1 CHECKLIST - CONCLUDED

# OWNERS / #PROP. |

$ REPORTED |

# SHARES |

|

|

|

MISC. CHECKS & INTANGIBLE PERSONAL PROPERTY

MS01 Wages, Payroll, Salary

MS02 Commissions

MS03 Workers Compensation Benefits

MS04 Payment for Goods & Services

MS05 Customer Overpayments

MS06 Unidentified Remittances

MS07 Unrefunded Overcharges

MS08 Accounts Payable

MS09 Credit Balances

MS10 Discounts Due

MS11 Refunds Due

MS12 Unredeemed Gift Certificates

MS13 Unclaimed Loan Collateral

MS14 Pension & Profit Sharing Plans

MS15 Dissolution or Liquidation

MS16 Misc Outstanding Checks

MS17 Misc Intangible Property

MS18 Suspense Liabilities

MS99 Aggregate

TOTAL

SAFE DEPOSIT BOX (SAFEKEEPING)

SD01 SD Box Net Proceeds

SD02 Other Safekeeping

TOTAL

SECURITIES

SC01 Dividends

SC02 Interest (Bond Coupons)

SC03 Principal Payments

SC04 Equity Payments

SC05 Profits

SC06 Funds to Purchase Shares

SC07 Funds for Stocks & Bonds

SC08 Shares of Stock (Returned by P.O.)

SC09 Cash For Fractional Shares

SC10 Unexchanged Shares of Successor Corp

SC11 Other Certs. of Ownership

SC12 Underlying Shares

SC13

of unsurrendered Stock or bonds

SC14 Debentures

SC15 US Government Securities

SC16 Mutual Fund Shares

SC17 Warrants (Rights)

SC18 Matured Bond Principal

SC19 Dividend Reinvestment Plans

SC20 Credit Balances

SC99 Aggregate

TOTAL

AP-1 CHECKLIST - CONCLUDED

|

|

|

# OWNERS / #PROP. |

$ REPORTED |

|

|

|

TRUST, INVESTMENT & ESCROW ACCOUNTS

TR01 Paying Agent Accounts

TR02 Undelivered or Uncashed Dividends

TR03 Funds Held In Fiduciary Capacity

TR04 Escrow Accounts

TR05 Trust Vouchers

TOTAL

UTILITIES

UT01 Utility Deposits

UT02 Membership Fees

UT03 Refunds or Rebates

UT04 Capital Credit Distributions

UT99 Aggregate

TOTAL

ALL OTHER PROPERTY NOT IDENTIFIED ABOVE

ZZZZ ALL OTHER PROPERTY

TOTAL

GRAND TOTAL *

* Please total all property categories and enter grand total on front of form AP-1 in the Report Recapitulation section.