DELAWARE MANUFACTURED HOME RELOCATION TRUST FUND - FORM LQ9

In accordance with Delaware House Bill No. 2 of the First Session of the 142nd Delaware General Assembly, any owner of a manufactured- home community must remit a monthly $3.00 assessment per rented lot to the Delaware Manufactured Home Relocation Trust Fund. One- half this amount ($1.50) is to be paid by the lot’s tenant and one-half ($1.50) by the lot’s owner. The Relocation Trust Fund has been created to financially assist manufactured-home owners forced to relocate due to land-use changes. The Fund will also pay for the transport of immovable mobile homes, as well as for the removal and/or disposal of abandoned homes left in a community.

The Delaware Manufactured Home Relocation Authority, which was created to administer the Trust Fund, adopted the monthly $3.00 assessment at its February 19, 2004 Board meeting.

The landlord of a manufactured-home community shall collect the tenant’s portion of the assessment on a monthly basis as additional rent. An assessment is not due or collectable for a vacant lot. If a lot is rented for any portion of a month, the full monthly assessment must be paid to the Trust Fund by both the tenant and the owner.

Included with Form LQ9 is a Schedule 1 listing for delinquent tenants who have failed to pay their one-half ($1.50) monthly Trust Fund assessment. Owners are to report all delinquent tenants each quarter using the Schedule 1. (Please photocopy the enclosed Schedule 1 for multiple copies.) Owners are still responsible for their portion of the assessment ($1.50) even if a tenant fails to pay. If a delinquent tenant

pays for a prior quarter, please report it on Line 4, Column B.

The assessment documents and payments are due the twentieth day after the close of each calendar quarter. Should you have any ques- tions regarding the Assessment Form, please call the Division of Revenue at (302) 577-8681. For questions regarding the Authority, please call the Delaware Manufactured Home Relocation Authority at (302) 674-7768.

Every owner and/or landlord of a manufactured-home community in Delaware must complete the enclosed Manufactured Home Relocation Trust Fund Form LQ9 and Schedule 1 on a quarterly basis. Please remit with payment to the following address:

DELAWARE DIVISION OF REVENUE, P.O. BOX 2340, WILMINGTON, DE 19899-2340

Please include the community name and address on each return. The community address should be the street address (no P.O. boxes) of the community in which the Manufactured Home Relocation Trust Fund payments were collected.

The tax parcel identification number should identify the land on which the community is located.

LINE-BY-LINE INSTRUCTIONS

Form LQ9

Column A. Insert the total number of manufactured-home lots rented each month on Lines 1, 2, and 3.

Column B. Insert the total assessment collected from tenants each month on Lines 1, 2, 3. Report any delinquent tenant payments from prior quarters on Line 4. Add Lines 1 through 4 and report their total in the fifth box under Column B.

Column C. Insert the total assessment collected from owners each month on Lines 1, 2, 3 and 4. Add Lines 1 through 4 and report their total in the fifth box under Column C.

Total Due. Add together the totals from Column B and Column C and report this amount in the box provided.

Schedule 1

1.If blank, enter the name of the Manufactured-Home Community Name (as used on Form LQ9) in the box provided.

2.If blank, enter the “Account Number” from your Form LQ9 in the “Account Number” box provided, and the “Tax Period Ending Date” from Form LQ9 in the “Report for Quarter Ending” box provided.

3.List on each row separately the Name, Address, Number of Months Delinquent and Total Amount due for each delinquent tenant.

4.When you have finished listing all delinquent tenants, add up the “Total Amount Oustanding” column and report this amount in the TOTAL box located at the bottom of Schedule 1.

PLEASE NOTE: Form LQ9 and its accompanying Schedule 1 must be signed and dated by an authorized representative of the remitting taxpayer or manufactured-home community. Photocopies or substitute documents will not be accepted.

TO REPORT ANY CHANGES TO YOUR PERSONAL INFORMATION PRINTED ON FORM LQ9,

PLEASE COMPLETE THE REQUEST FOR CHANGE FORM AT THE END OF THIS PACKET.

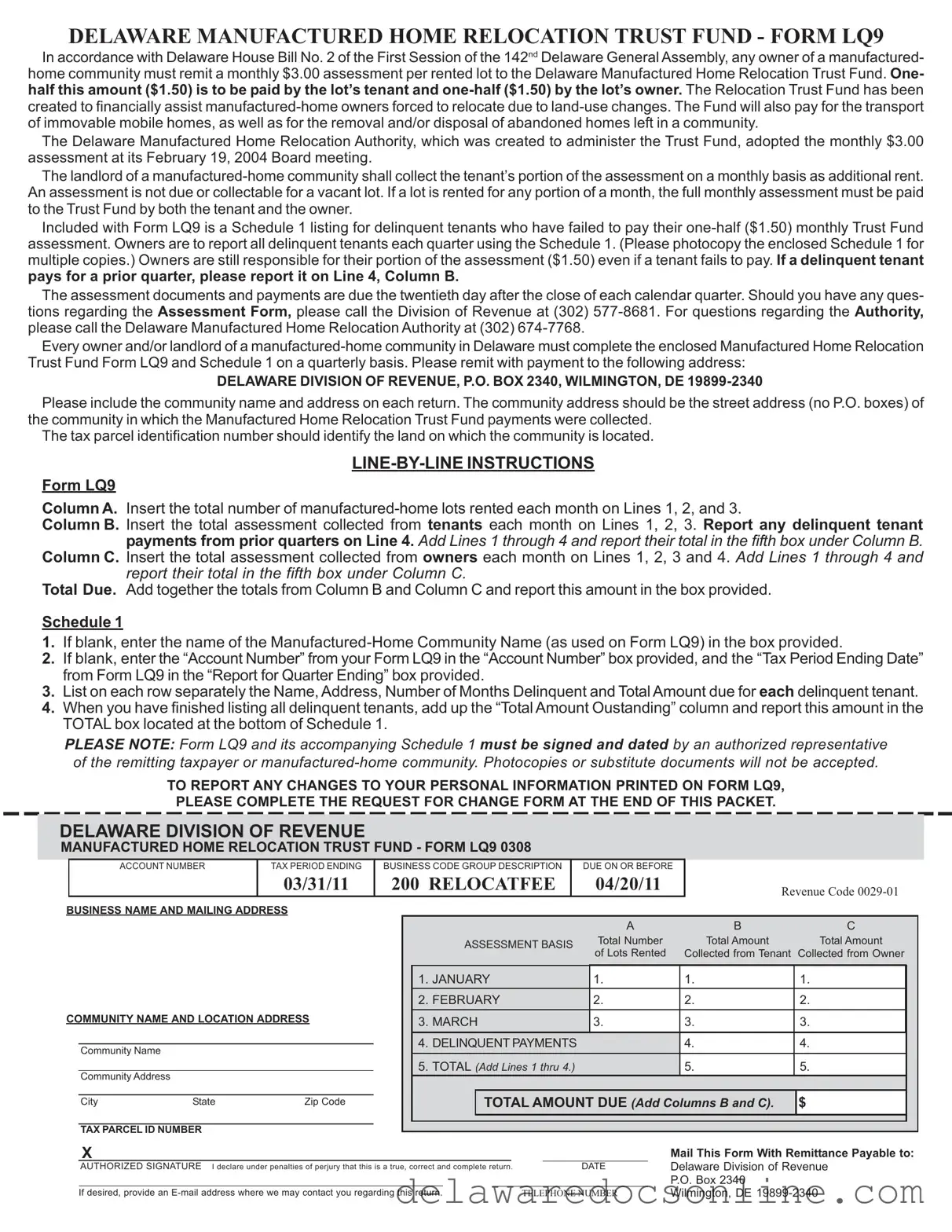

DELAWARE DIVISION OF REVENUE

MANUFACTURED HOME RELOCATION TRUST FUND - FORM LQ9 0308

|

|

ACCOUNT NUMBER |

TAX PERIOD ENDING |

BUSINESS CODE GROUP DESCRIPTION |

|

DUE ON OR BEFORE |

|

|

|

|

|

|

|

|

03/31/11 |

200 RELOCATFEE |

|

04/20/11 |

|

|

REVENUE CODE 0029-01 |

|

BUSINESS NAME AND MAILING ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A |

|

|

B |

C |

|

|

|

|

|

|

|

|

|

|

ASSESSMENT BASIS |

|

Total Number |

|

|

Total Amount |

Total Amount |

|

|

|

|

|

|

|

|

|

|

|

of Lots Rented |

|

|

Collected from Tenant |

Collected from Owner |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

JANUARY |

|

|

|

|

|

1. |

|

|

|

1. |

1. |

|

|

|

|

|

|

|

|

|

2. |

FEBRUARY |

|

|

|

|

|

2. |

|

|

|

2. |

2. |

|

|

COMMUNITY NAME AND LOCATION ADDRESS |

|

|

3. |

MARCH |

|

|

|

|

|

3. |

|

|

|

3. |

3. |

|

|

|

|

|

|

|

|

|

4. |

DELINQUENT PAYMENTS |

|

|

|

|

|

4. |

4. |

|

|

|

|

Community Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

TOTAL (Add Lines 1 thru 4.) |

|

|

|

|

|

5. |

5. |

|

|

|

|

Community Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL AMOUNT DUE (Add Columns B and C). |

$ |

|

|

|

|

City |

State |

Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TAX PARCEL ID NUMBER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

X |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mail This Form With Remittance Payable to: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AUTHORIZED SIGNATURE I declare under penalties of perjury that this is a true, correct and complete return. |

|

|

|

|

DATE |

Delaware Division of Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

P.O. Box 2340 |

|

|

|

|

|

If desired, provide an E-mail address where we may contact you regarding this return. |

TELEPHONE NUMBER |

Wilmington, DE 19899-2340 |

|

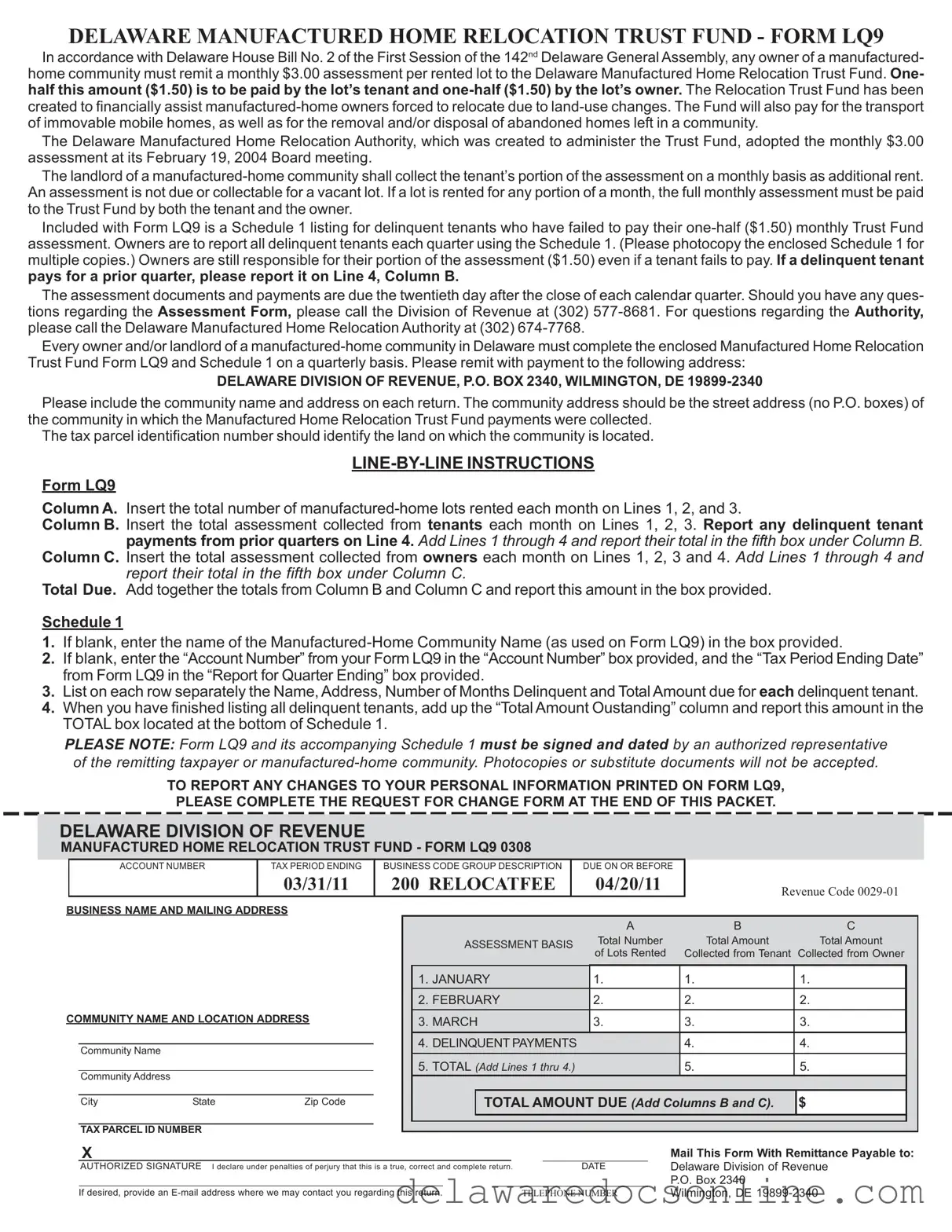

DELAWARE DIVISION OF REVENUE

MANUFACTURED HOME RELOCATION TRUST FUND - FORM LQ9 0308

|

|

|

|

|

|

|

|

ACCOUNT NUMBER |

|

|

TAX PERIOD ENDING |

|

|

BUSINESS CODE GROUP DESCRIPTION |

DUE ON OR BEFORE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

06/30/11 |

|

|

|

|

|

200 RELOCATFEE |

07/20/11 |

|

|

|

|

|

|

|

|

|

|

|

|

REVENUE CODE 0029-01 |

|

|

|

|

BUSINESS NAME AND MAILING ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A |

|

|

|

|

|

|

|

B |

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSESSMENT BASIS |

|

|

|

Total Number |

|

|

Total Amount Collected |

|

|

|

Total Amount |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

of Lots Rented |

|

|

|

|

from Tenant |

Collected from Owner |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

APRIL |

|

|

|

|

|

|

|

|

|

|

1. |

|

|

|

|

|

|

|

|

|

|

1. |

|

|

|

|

|

|

|

|

|

1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

MAY |

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMMUNITY NAME AND LOCATION ADDRESS |

|

|

|

|

|

3. |

JUNE |

|

|

|

|

|

|

|

|

|

|

3. |

|

|

|

|

|

|

|

|

|

|

|

3. |

|

|

|

|

|

|

|

|

|

3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

DELINQUENT PAYMENTS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

|

|

|

|

|

|

|

|

|

4. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Community Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

TOTAL (Add Lines 1 thru 4.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

|

|

|

|

|

|

|

|

|

5. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Community Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL AMOUNT DUE (Add Columns B and C). |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

State |

|

|

|

|

|

Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TAX PARCEL ID NUMBER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

X |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mail This Form With Remittance Payable to: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AUTHORIZED SIGNATURE I declare under penalties of perjury that this is a true, correct and complete return. |

|

|

|

|

|

|

|

|

|

DATE |

Delaware Division of Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

P.O. Box 2340 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If desired, provide an E-mail address where we may contact you regarding this return. |

TELEPHONE NUMBER |

Wilmington, DE 19899-2340 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DELAWARE DIVISION OF REVENUE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MANUFACTURED HOME RELOCATION TRUST FUND - FORM LQ9 0308 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ACCOUNT NUMBER |

|

|

TAX PERIOD ENDING |

|

|

BUSINESS CODE GROUP DESCRIPTION |

DUE ON OR BEFORE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

09/30/11 |

|

|

|

|

|

200 RELOCATFEE |

10/20/11 |

|

|

|

|

|

|

|

|

|

|

|

|

REVENUE CODE 0029-01 |

|

|

|

|

BUSINESS NAME AND MAILING ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A |

|

|

|

|

|

|

|

B |

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSESSMENT BASIS |

|

|

|

Total Number |

|

|

Total Amount Collected |

|

|

|

Total Amount |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

of Lots Rented |

|

|

|

|

from Tenant |

Collected from Owner |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

JULY |

|

|

|

|

|

|

|

|

|

|

1. |

|

|

|

|

|

|

|

|

|

|

1. |

|

|

|

|

|

|

|

|

|

1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

AUGUST |

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMMUNITY NAME AND LOCATION ADDRESS |

|

|

|

|

|

3. |

SEPTEMBER |

|

|

|

|

|

|

|

|

|

|

3. |

|

|

|

|

|

|

|

|

|

|

3. |

|

|

|

|

|

|

|

|

|

3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

DELINQUENT PAYMENTS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

|

|

|

|

|

|

|

|

|

4. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Community Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

TOTAL (Add Lines 1 thru 4.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

|

|

|

|

|

|

|

|

|

5. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Community Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL AMOUNT DUE (Add Columns B and C). |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

State |

|

|

|

|

|

Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TAX PARCEL ID NUMBER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

X |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mail This Form With Remittance Payable to: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AUTHORIZED SIGNATURE I declare under penalties of perjury that this is a true, correct and complete return. |

|

|

|

|

|

|

|

|

|

DATE |

Delaware Division of Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

P.O. Box 2340 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If desired, provide an E-mail address where we may contact you regarding this return. |

TELEPHONE NUMBER |

Wilmington, DE 19899-2340 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DELAWARE DIVISION OF REVENUE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MANUFACTURED HOME RELOCATION TRUST FUND - FORM LQ9 0308 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ACCOUNT NUMBER |

|

|

TAX PERIOD ENDING |

|

|

BUSINESS CODE GROUP DESCRIPTION |

DUE ON OR BEFORE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12/31/11 |

|

|

|

|

|

200 RELOCATFEE |

01/20/12 |

|

|

|

|

|

|

|

|

|

|

|

|

REVENUE CODE 0029-01 |

|

|

|

|

BUSINESS NAME AND MAILING ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A |

|

|

|

|

|

|

B |

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSESSMENT BASIS |

|

|

|

Total Number |

|

|

Total Amount Collected |

|

|

|

Total Amount |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

of Lots Rented |

|

|

|

|

from Tenant |

Collected from Owner |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

OCTOBER |

|

|

|

|

|

|

|

|

|

|

1. |

|

|

|

|

|

|

|

|

|

|

1. |

|

|

|

|

|

|

|

|

|

1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

NOVEMBER |

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMMUNITY NAME AND LOCATION ADDRESS |

|

|

|

|

|

3. |

DECEMBER |

|

|

|

|

|

|

|

|

|

|

3. |

|

|

|

|

|

|

|

|

|

|

3. |

|

|

|

|

|

|

|

|

|

3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

DELINQUENT PAYMENTS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

|

|

|

|

|

|

|

|

|

4. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Community Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

TOTAL (Add Lines 1 thru 4.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

|

|

|

|

|

|

|

|

|

5. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Community Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL AMOUNT DUE (Add Columns B and C). |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

State |

|

|

|

|

|

Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TAX PARCEL ID NUMBER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

X |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mail This Form With Remittance Payable to: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AUTHORIZED SIGNATURE I declare under penalties of perjury that this is a true, correct and complete return. |

|

|

|

|

|

|

|

|

|

DATE |

Delaware Division of Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

P.O. Box 2340 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If desired, provide an E-mail address where we may contact you regarding this return. |

TELEPHONE NUMBER |

Wilmington, DE 19899-2340 |

|

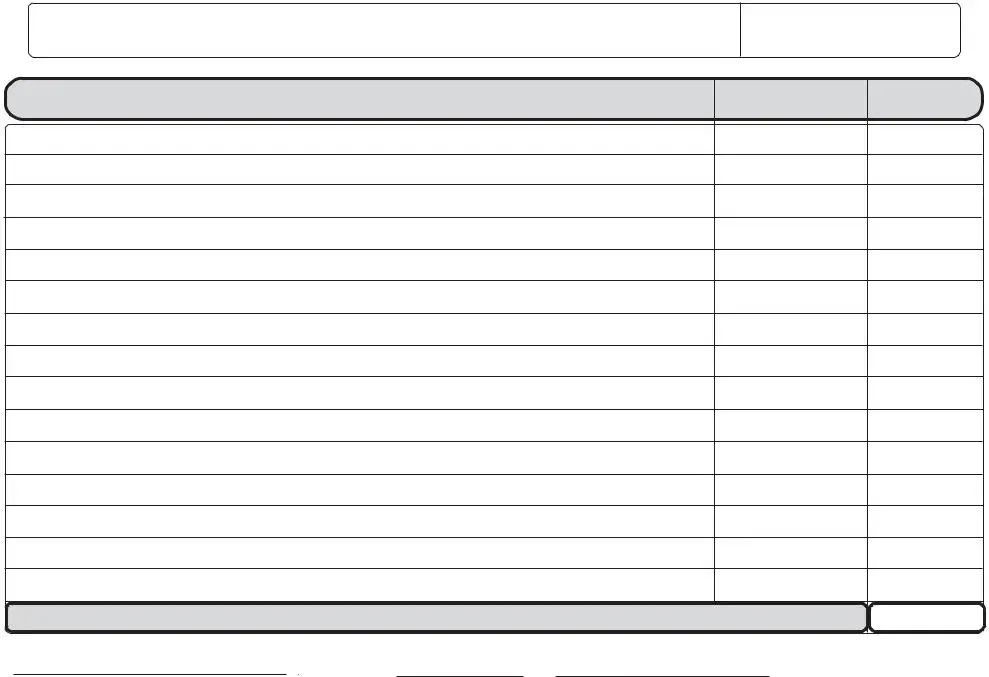

DELAWARE MANUFACTURED HOME RELOCATION TRUST FUND

Schedule 1 - Delinquent Tenant Report

|

MANUFACTURED-HOME |

ACCOUNT NUMBER |

REPORT FOR QUARTER ENDING: |

|

COMMUNITY OWNER |

|

|

|

|

|

|

|

NAME OF DELINQUENT TENANT |

STREET ADDRESS |

CITY |

STATE |

ZIP CODE |

|

|

|

|

|

|

|

|

|

|

BUSINESS CODE GROUP DESCRIPTION

200 RELOCATFEE

NUMBER OF MONTHS |

TOTAL AMOUNT |

DELINQUENT |

OUTSTANDING |

Mail This Form With Remittance Payable To:

Delaware Division of Revenue

P.O. Box 2340, Wilmington, DE 19899-2340

AUTHORIZED SIGNATURE I declare under penalties of perjury, that this |

DATE |

TELEPHONE NUMBER |

E-MAILADDRESS |

is a true, correct and complete return. |

|

|

|

Delaware Manufactured Home Relocation Trust Fund - Form LQ9

Request for Change Form

Use this form to make corrections or changes to your name, address, account number or taxable year-ending date. Also use this Request for Change form if you have gone out of business and indicate the date your business ceased operations.

Please Note: This Request for Change form only makes changes to your account in our Business Master File. If you need to make similar changes to any other accounts (Corporate, Sub S Corporate, License and/or Withholding accounts), please complete the Corporate Request for Change form, the Sub S Corporate Request for Change form, the License Request for Change form or the Withholding Request for Change form respectively for each type of tax. These forms can be found on our website at: www.revenue.delaware.gov.

Please Note: This Request for Change form only makes changes to your account in our Business Master File. If you need to make similar changes to any other accounts (Corporate, Sub S Corporate, License and/or Withholding accounts), please complete the Corporate Request for Change form, the Sub S Corporate Request for Change form, the License Request for Change form or the Withholding Request for Change form respectively for each type of tax. These forms can be found on our website at: www.revenue.delaware.gov.

Step-by-Step Instructions

Step 1: Please enter your information as it appears on the Division of Revenue’s current records

Box A. Account Number – Please enter the Federal Tax Identification Number that the Delaware Division of Revenue currently has on file for you.

Box B. Business Name and Address – Please enter the business name and location address that the Delaware Division of Revenue currently lists as your business name and location address.

Step 2: Fill-in any fields you wish to change on the Request for Change form below

Field 1. Correct Business Activity – If you have changes to your current business activity, please enter your new or corrected business activity in Field 1.

Field 2. Account Number Change – If you wish to change the information in Box A, please enter your correct account number in Field 2. Otherwise, leave Field 2 blank.

Field 3. Effective Date – Please enter the date you would like this Request for Change form to go into effect. Field 4. Reason for Change – Please enter the reason for submitting this Request for Change form (i.e. out

of business, incorporated, moved).

Field 5. Sole Propietors Only – Please enter your current Social Security Number if you are a sole proprietor. If you are not a sole proprietor, please leave Field 5 blank.

Field 6. Correct Community Address – If you wish to change the information in Box B, please enter your correct location address in Field 6. Otherwise, leave Field 6 blank.

Field 7. Correct Mailing Address – Please enter your correct mailing address.

Step 3: Sign and date the form. Mail to the address listed on the form or fax to 302-577-8203.

If you have any questions, please call the Delaware Division of Revenue Business Master File Section at 302-577-8778.

|

DELAWARE DIVISION OF REVENUE |

REQUEST FOR CHANGE |

|

|

LREQ |

|

PO BOX 8750 |

|

|

New Booklets Will Be Issued |

|

|

|

WILMINGTON, DE 19899-8750 |

for Account No. & Bus. Code Group Changes Only |

|

|

|

|

|

|

|

|

|

|

|

|

|

REVENUE CODE 0029-99 |

|

|

|

|

|

|

|

|

|

|

|

|

1. CORRECT BUSINESS ACTIVITY |

|

2. ACCOUNT NUMBER CHANGE |

3. EFFECTIVE DATE |

4. REASON FOR CHANGE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BUSINESS CODE GROUP DESCRIPTION |

|

A. ACCOUNT NUMBER |

6. CORRECT BUSINESS LOCATION ADDRESS |

|

|

200 RELOCATFEE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

SOLE PROPRIETORS: ENTER |

|

|

|

|

|

B. BUSINESS NAME |

|

SOCIAL SECURITY NUMBER |

|

|

|

|

|

|

|

|

|

|

ADDRESS |

|

|

|

|

|

AND MAILING ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY |

|

STATE |

ZIP CODE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7. CORRECT MAILING ADDRESS IF DIFFERENT FROM ABOVE |

|

|

|

|

|

|

|

|

|

NAME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AUTHORIZED SIGNATURE |

|

|

DATE |

|

|

|

|

|

|

|

|

CITY |

|

STATE |

ZIP CODE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TELEPHONE NUMBER |

E-MAIL ADDRESS |