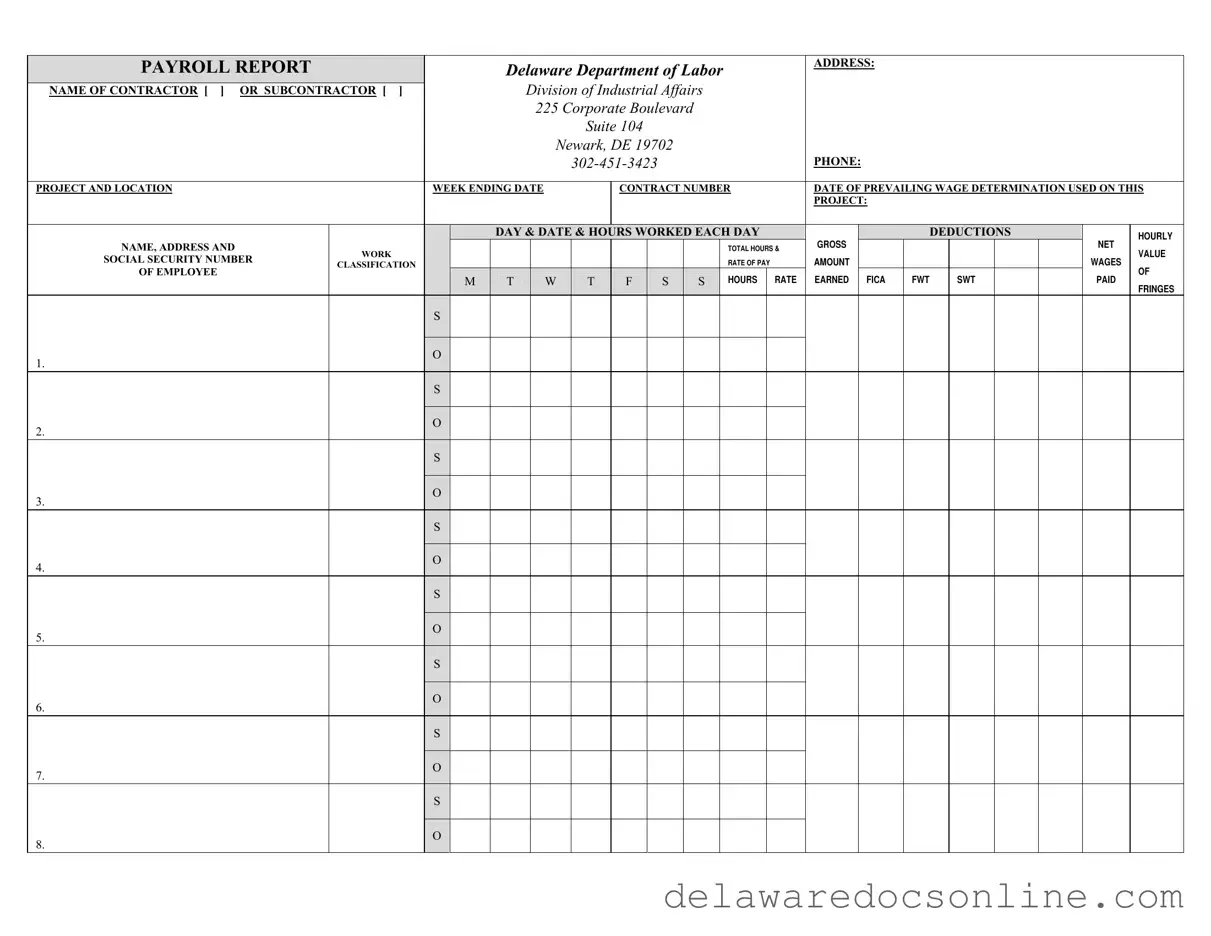

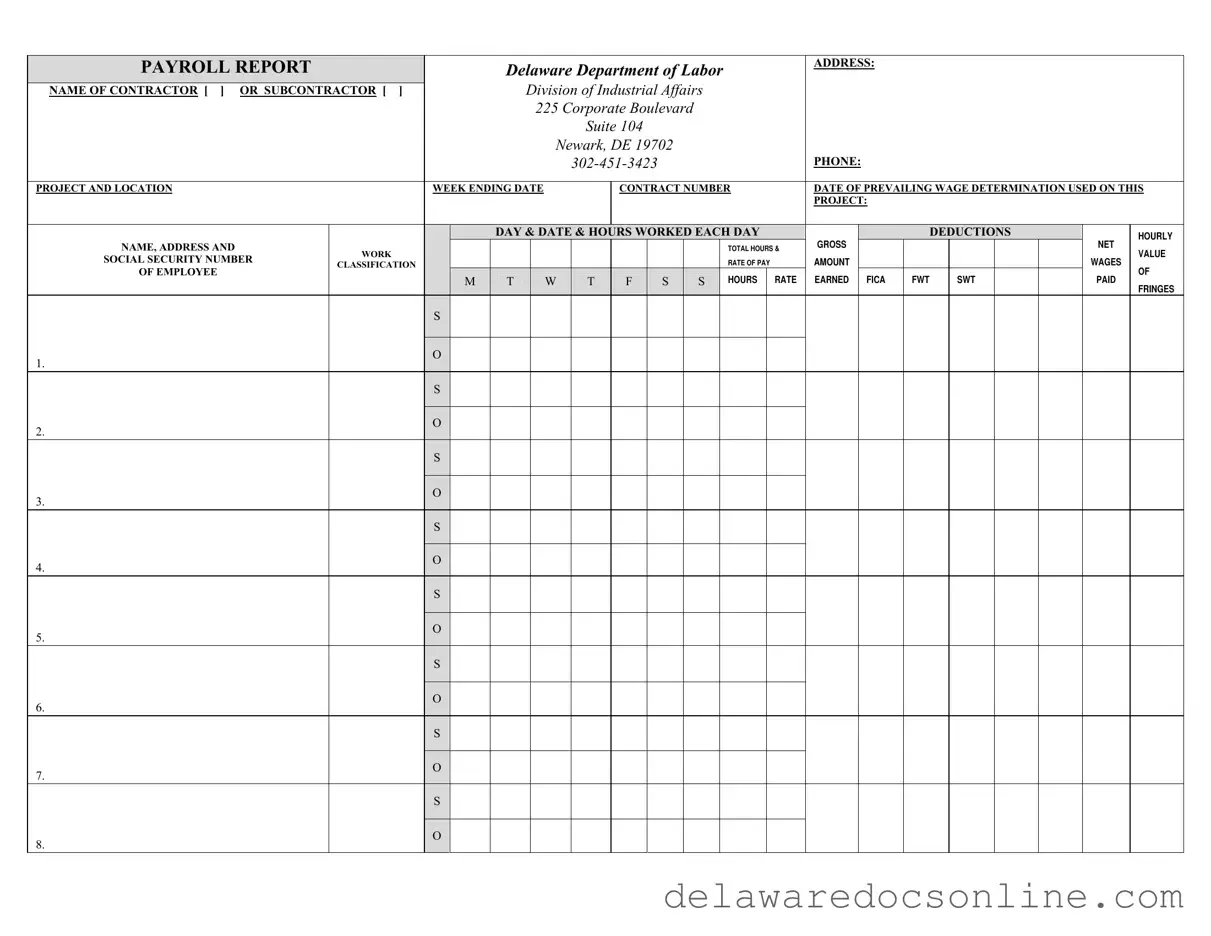

Fill Out Your Delaware Payroll Report Form

The Delaware Payroll Report form is a document required by the State of Delaware for contractors and subcontractors working on public projects. This form ensures that all employees are paid their full wages and that the payroll information submitted is accurate and complete. Compliance with this requirement is crucial, as failure to submit the form can result in significant fines.

Make Your Delaware Payroll Report Now

Fill Out Your Delaware Payroll Report Form

Make Your Delaware Payroll Report Now

Make Your Delaware Payroll Report Now

or

⇓ PDF File

Need speed? Complete the form now

Edit, save, download — finish Delaware Payroll Report online with ease.