|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Submitted by: (select one) |

|

|

|

|

DELAWARE INSURANCE DEPARTMENT |

|

|

|

|

PRODUCER |

|

|

|

|

|

|

|

SURPLUS LINES |

|

|

|

|

SL BROKER |

|

|

|

|

|

|

STATEMENT OF DILIGENT EFFORT |

|

|

|

Form SL-1904 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

v.06-2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

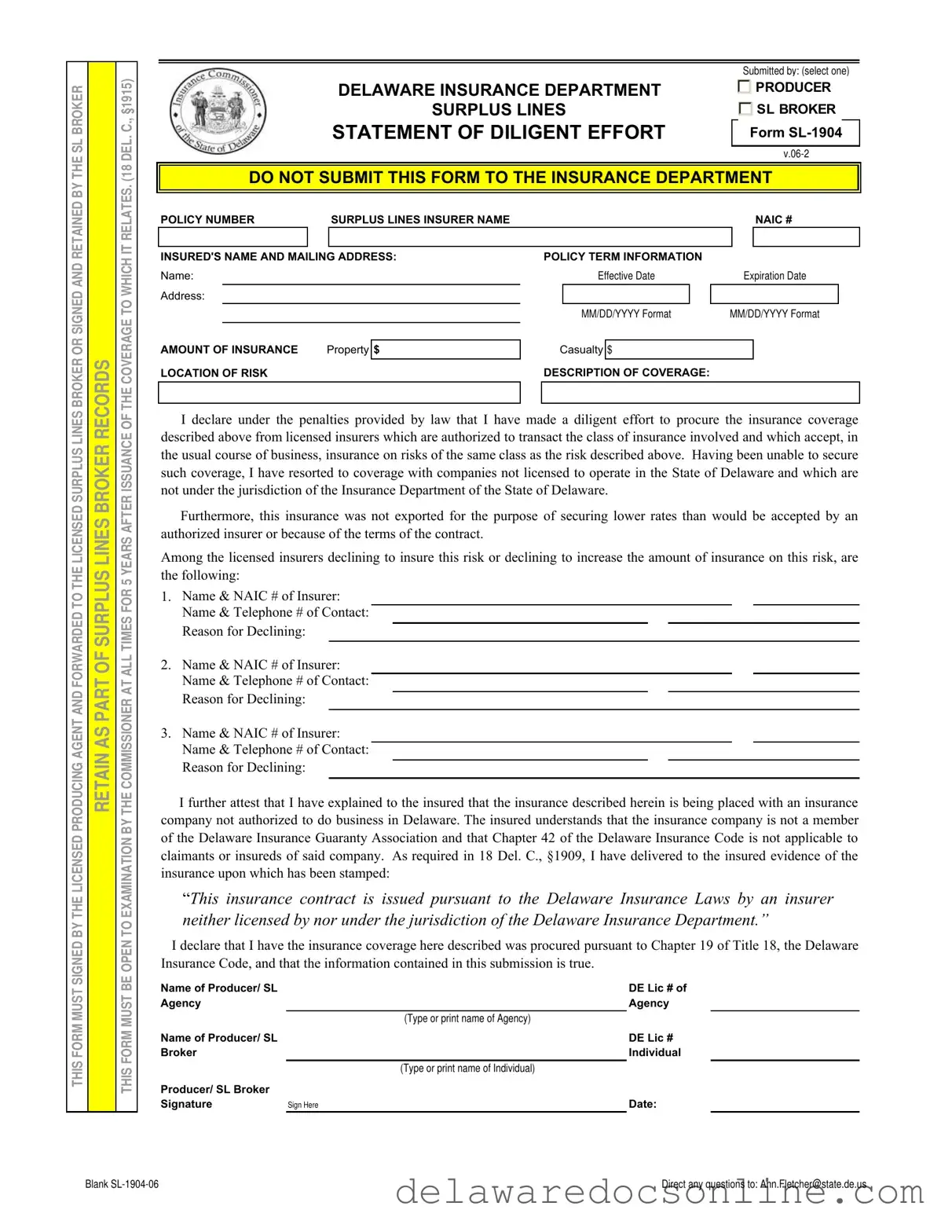

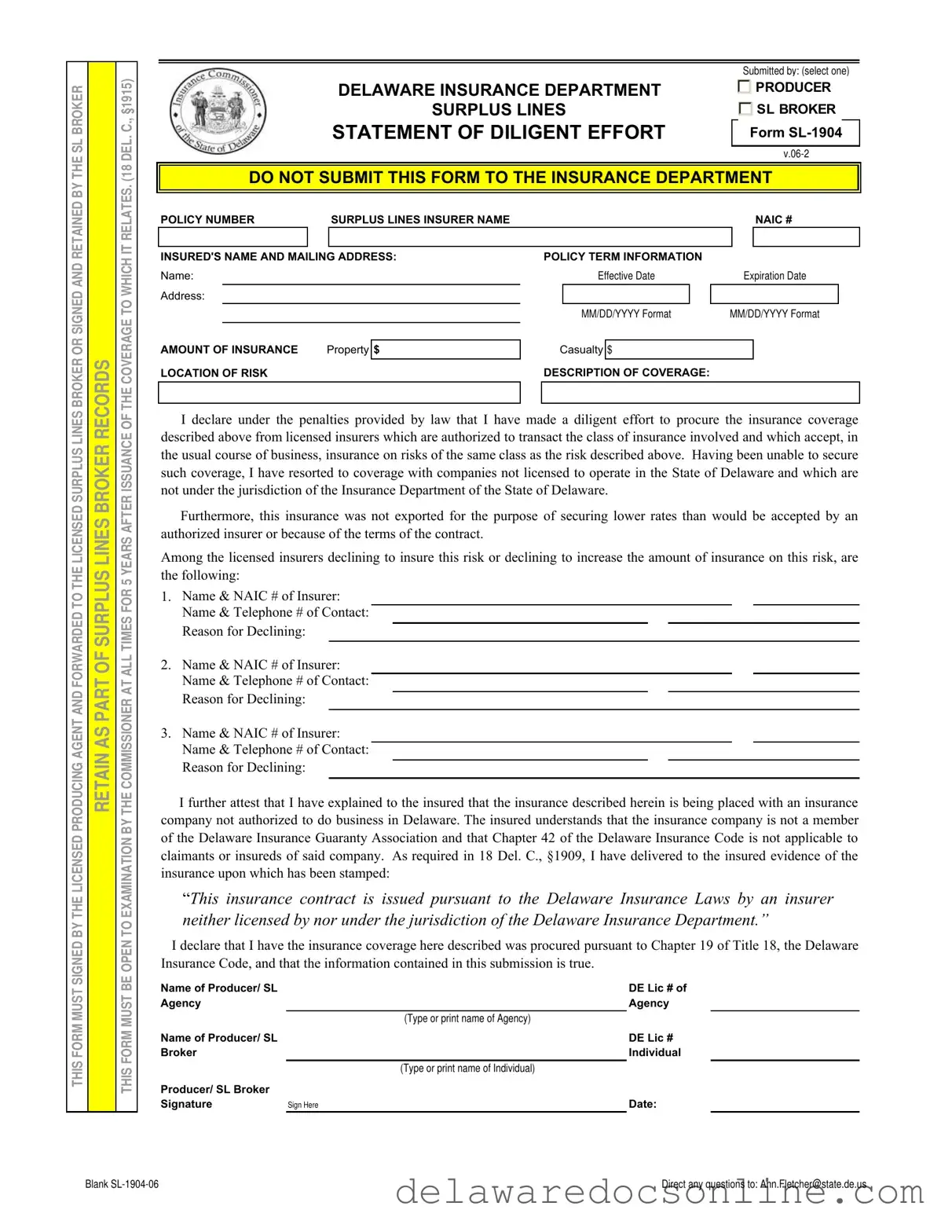

DO NOT SUBMIT THIS FORM TO THE INSURANCE DEPARTMENT |

|

POLICY NUMBER |

|

SURPLUS LINES INSURER NAME |

|

|

|

|

NAIC # |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INSURED'S NAME AND MAILING ADDRESS: |

|

|

POLICY TERM INFORMATION |

|

|

|

|

|

|

|

|

|

Name: |

|

|

|

|

|

|

|

Effective Date |

|

|

|

|

Expiration Date |

|

|

Address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MM/DD/YYYY Format |

MM/DD/YYYY Format |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AMOUNT OF INSURANCE |

Property |

$ |

|

|

Casualty |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LOCATION OF RISK |

|

|

|

|

|

DESCRIPTION OF COVERAGE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I declare under the penalties provided by law that I have made a diligent effort to procure the insurance coverage described above from licensed insurers which are authorized to transact the class of insurance involved and which accept, in the usual course of business, insurance on risks of the same class as the risk described above. Having been unable to secure such coverage, I have resorted to coverage with companies not licensed to operate in the State of Delaware and which are not under the jurisdiction of the Insurance Department of the State of Delaware.

Furthermore, this insurance was not exported for the purpose of securing lower rates than would be accepted by an authorized insurer or because of the terms of the contract.

Among the licensed insurers declining to insure this risk or declining to increase the amount of insurance on this risk, are the following:

1.Name & NAIC # of Insurer: Name & Telephone # of Contact:

Reason for Declining:

2.Name & NAIC # of Insurer: Name & Telephone # of Contact: Reason for Declining:

3.Name & NAIC # of Insurer: Name & Telephone # of Contact: Reason for Declining:

I further attest that I have explained to the insured that the insurance described herein is being placed with an insurance company not authorized to do business in Delaware. The insured understands that the insurance company is not a member of the Delaware Insurance Guaranty Association and that Chapter 42 of the Delaware Insurance Code is not applicable to claimants or insureds of said company. As required in 18 Del. C., §1909, I have delivered to the insured evidence of the insurance upon which has been stamped:

“This insurance contract is issued pursuant to the Delaware Insurance Laws by an insurer neither licensed by nor under the jurisdiction of the Delaware Insurance Department.”

I declare that I have the insurance coverage here described was procured pursuant to Chapter 19 of Title 18, the Delaware Insurance Code, and that the information contained in this submission is true.

Name of Producer/ SL |

|

|

DE Lic # of |

Agency |

|

|

Agency |

|

|

(Type or print name of Agency) |

Name of Producer/ SL |

|

|

DE Lic # |

Broker |

|

|

Individual |

|

|

(Type or print name of Individual) |

Producer/ SL Broker |

|

|

|

Signature |

Sign Here |

|

Date: |