Fill Out Your Delaware Uc 400 Form

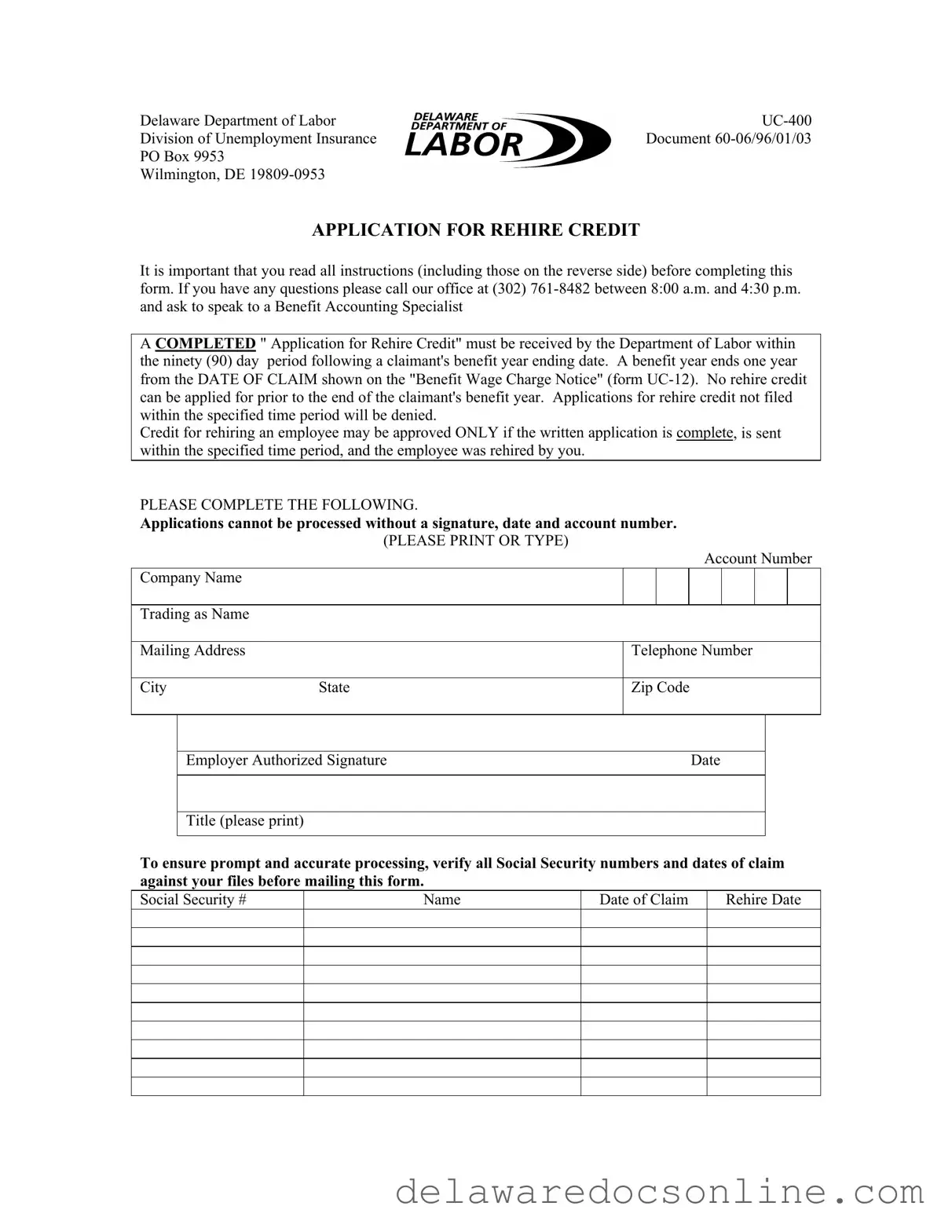

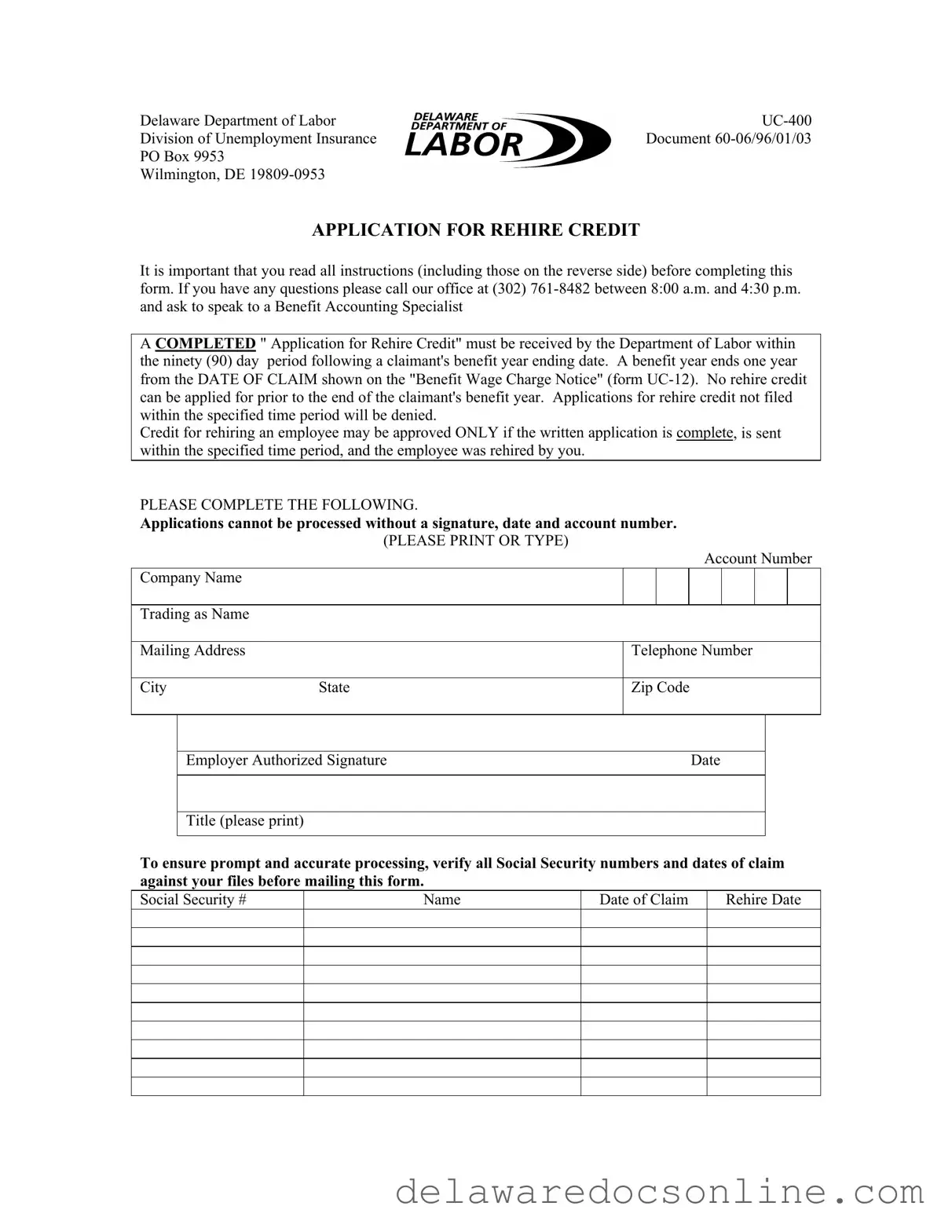

The Delaware UC-400 form is an application used by employers to request a rehire credit from the Delaware Department of Labor's Division of Unemployment Insurance. This form must be completed and submitted within ninety days following the end of a claimant's benefit year to be considered valid. Timely submission and accurate information are crucial for the approval of the rehire credit.

Make Your Delaware Uc 400 Now

Fill Out Your Delaware Uc 400 Form

Make Your Delaware Uc 400 Now

Make Your Delaware Uc 400 Now

or

⇓ PDF File

Need speed? Complete the form now

Edit, save, download — finish Delaware Uc 400 online with ease.