Attorney-Verified Promissory Note Document for Delaware

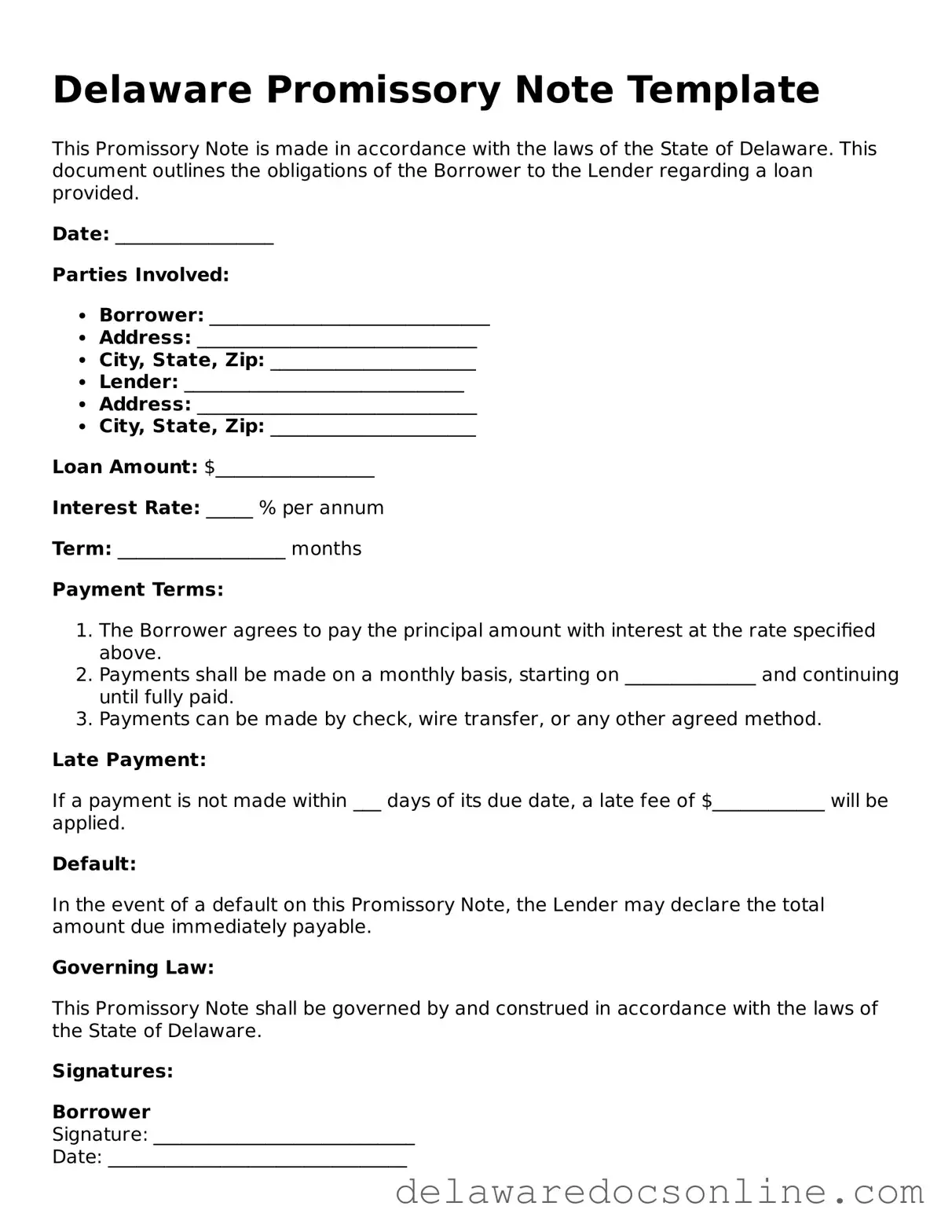

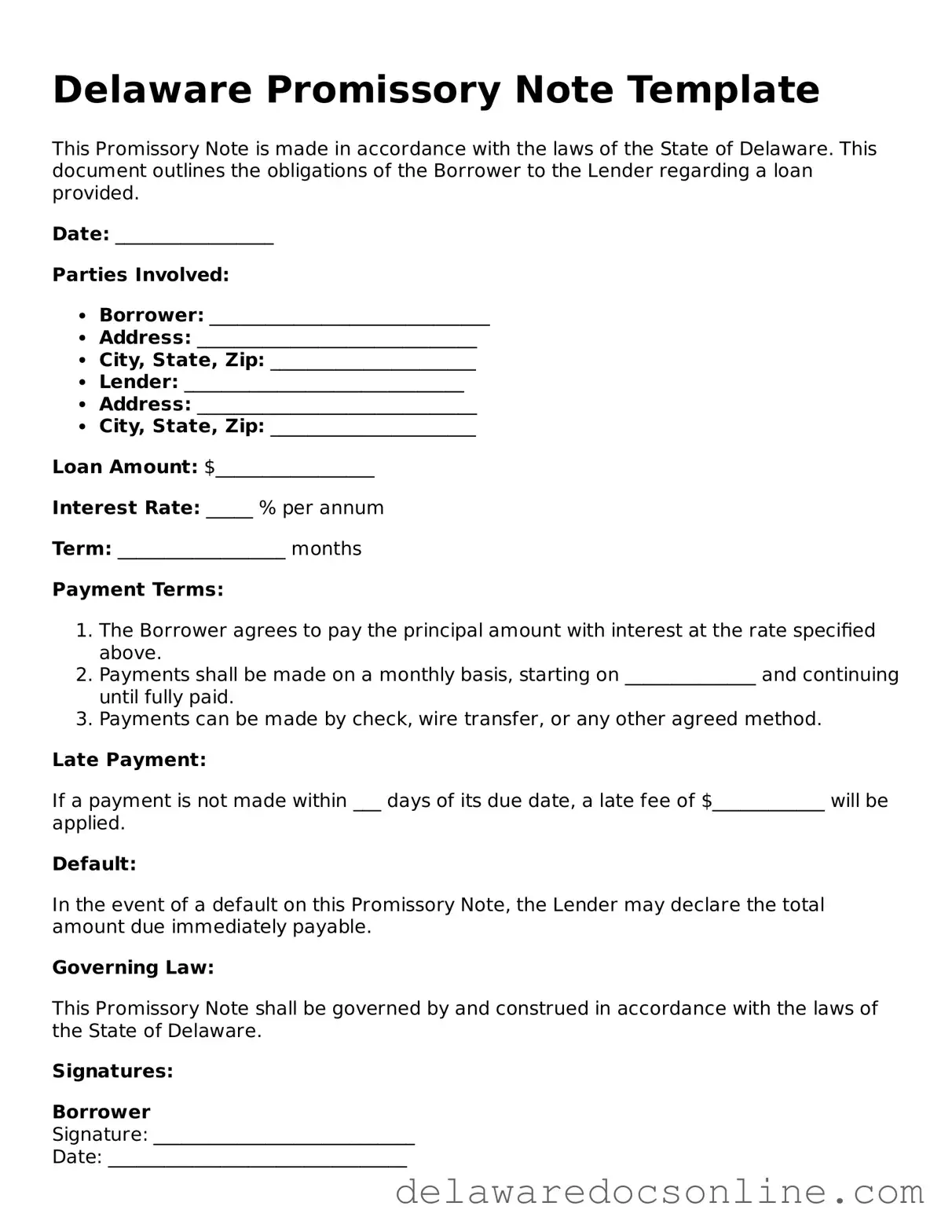

A Delaware Promissory Note is a written promise to pay a specified amount of money to a lender at a designated time. This legal document outlines the terms of the loan, including the interest rate and repayment schedule. Understanding this form is essential for both borrowers and lenders to ensure clear communication and legal protection in financial transactions.

Make Your Promissory Note Now

Attorney-Verified Promissory Note Document for Delaware

Make Your Promissory Note Now

Make Your Promissory Note Now

or

⇓ PDF File

Need speed? Complete the form now

Edit, save, download — finish Promissory Note online with ease.