Attorney-Verified Small Estate Affidavit Document for Delaware

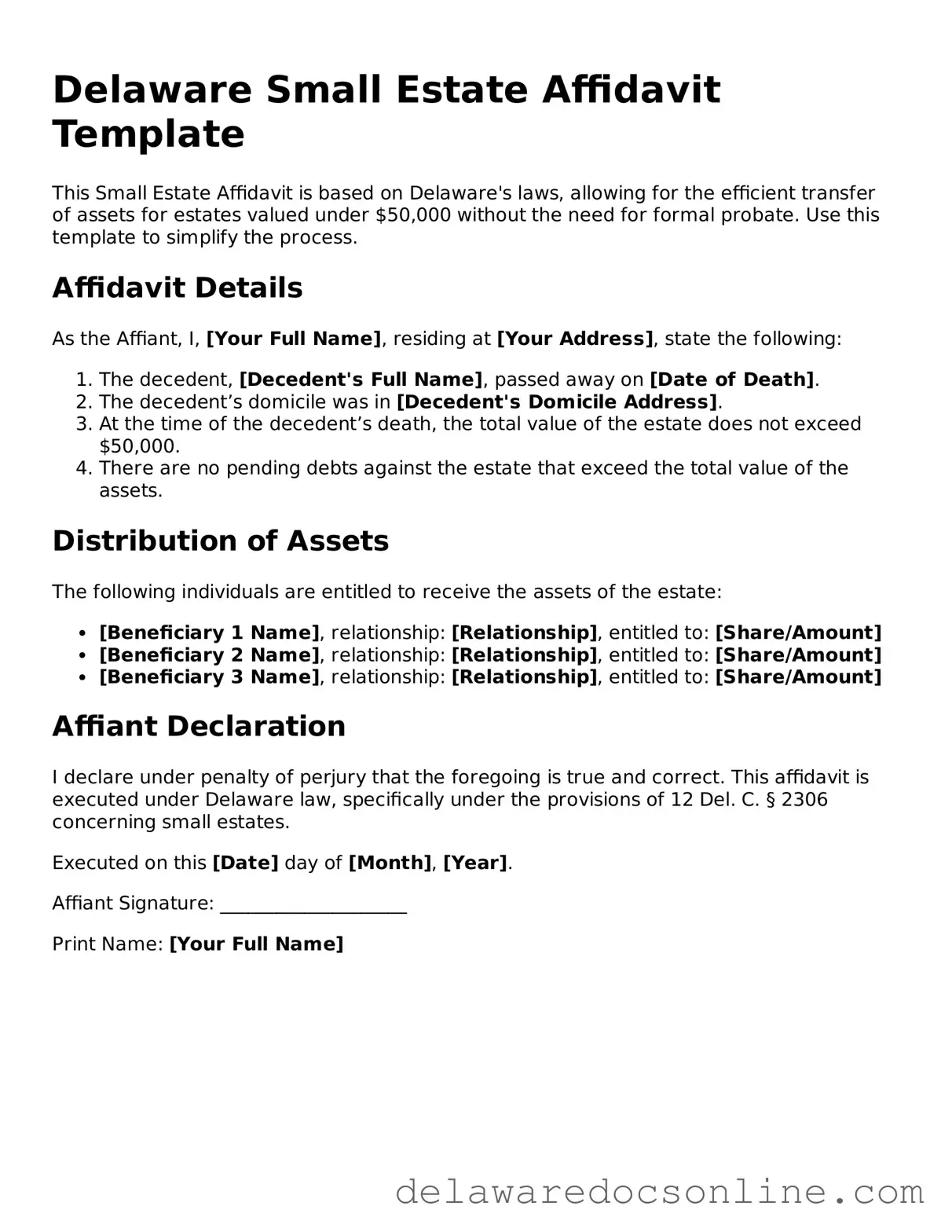

The Delaware Small Estate Affidavit form is a legal document that allows individuals to settle the estate of a deceased person without going through the lengthy probate process. This form is typically used when the total value of the estate is below a certain threshold, simplifying the transfer of assets to the rightful heirs. Understanding how to properly complete and file this affidavit can help streamline the process during a challenging time.

Make Your Small Estate Affidavit Now

Attorney-Verified Small Estate Affidavit Document for Delaware

Make Your Small Estate Affidavit Now

Make Your Small Estate Affidavit Now

or

⇓ PDF File

Need speed? Complete the form now

Edit, save, download — finish Small Estate Affidavit online with ease.